Paying tax in one country is daunting in itself, let alone in two. This is one of the primary concerns for NRIs every year while navigating finances in their country of residence and India. Thankfully, India has a Double Taxation Avoidance Agreement with 85+ countries. Non-resident Indians residing in these countries can avoid paying double taxes on their income.

In this article, we will delve into the Double Taxation Avoidance Agreement and how NRIs can benefit from it.

What is a Double Taxation Avoidance Agreement?

Double taxation occurs when an individual has to pay tax on their income in two countries- the country of residence and the home country. For example, a person working abroad also earns income in India via rent, interest on FDs, etc. In that case, he/she has to pay tax on that income twice, in both countries.

To offer double tax relief for Indians living abroad, India has signed a tax treaty with 85+ countries called the ‘Double Taxation Avoidance Agreement.’ With the help of DTAA NRIs, PIOs, and OCIs can seek exemption for tax they already paid in India while filing an ITR in their resident country.

Methods of Double Taxation Avoidance Agreement for NRIs

DTAA helps NRIs lower their tax liability using three methods:

1. Tax Credit

Non-resident Indians are eligible to utilize tax credits in their country of residence if they’ve paid tax on their income in India. Or, they can claim foreign tax credits to lower their tax liability in India. Let’s say you’re living in the US and have earned $100,000 in salary. You’ll have to pay 22% i.e. $22,000 tax in the US. You’ve also earned INR 5,00,000 as rental income in India. As per the tax slabs in India, let’s assume you owe INR. 1,50,000 in tax. Assuming the currency exchange rate of INR. 85 per dollar, your combined global income will be: INR. 85,00,000 (US income) + INR. 5,00,000 (Rental income in India)= INR. 90,00,000. Your tax liability in India will be approximately INR. 27,00,000. However, you’ve already paid a tax worth INR. 18,70,000 in the US. Therefore, while paying tax in India, you can use foreign tax credits worth INR. 18,70,000 to avoid double taxation on foreign income.

2. Exemption

In the exemption method, you only have to pay tax in the country where you are working on certain types of income. You can obtain a Tax Residence Certificate which allows you to get tax exemption in India on incomes eligible under this method.

3. Deduction Method

This method allows you to claim taxes paid to the foreign government as a deduction.

Documents Required to Claim DTAA Benefits

1. Tax Residency Certificate (TRC): TRC is a crucial document issued by the tax authorities of your country of residence. This document verifies your residential status in the foreign country while filing ITR as NRI in India.

2. Form 10F: TRC may not offer all the information required to claim DTAA. In that case, you can fill the Form 10F online. It’s a self-declaration form to provide the additional information that the TRC lacks.

3. Form 67: NRIs can claim foreign tax credits by filling out Form 67. While paying the tax in India, NRIs can pay tax on global income using foreign tax credits. For example, you’ve received dividend income in the US and already paid tax on it. You can use those tax credits to pay tax on the same income in India.

4. You may also need additional documents such as a PAN card, Passport copy, and Visa copy to claim DTAA.

Note: The process to get relief on double taxation may vary based on your current country of residence. The tax rates and the exemption methods may also vary accordingly.

What Type of Income Comes Under DTAA?

As per the double taxation avoidance agreement, NRIs do not have to pay double tax on the following type of income:

1. Services provided in India.

2. Salary received in India.

3. House property located in India.

4. Capital gains on transfer of assets in India.

5. Fixed deposits in India.

6. Savings bank account in India.

Countries That Have Double Taxation Avoidance Agreement with India

India has DTAA with 85+ countries. The TDS rates for the few are mentioned below.

| Country | TDS Rate |

| USA | 15% |

| UK | 15% |

| Canada | 15% |

| Dubai | 12.5% |

| Oman | 10% |

| Singapore | 15% |

| Malaysia | 10% |

| Spain | 10% |

| Australia | 15% |

| Germany | 10% |

Conclusion

The aim behind signing the Double Taxation Avoidance Agreement (DTAA) was to provide double tax relief to NRIs/PIOs/OCIs. India has signed the DTAA with more than 85 countries, allowing NRIs to pay a fair tax on their income in two different countries. Non-resident Indians can claim tax exemptions using the combination of methods mentioned above. That way, they do not have to pay taxes twice on the same income.

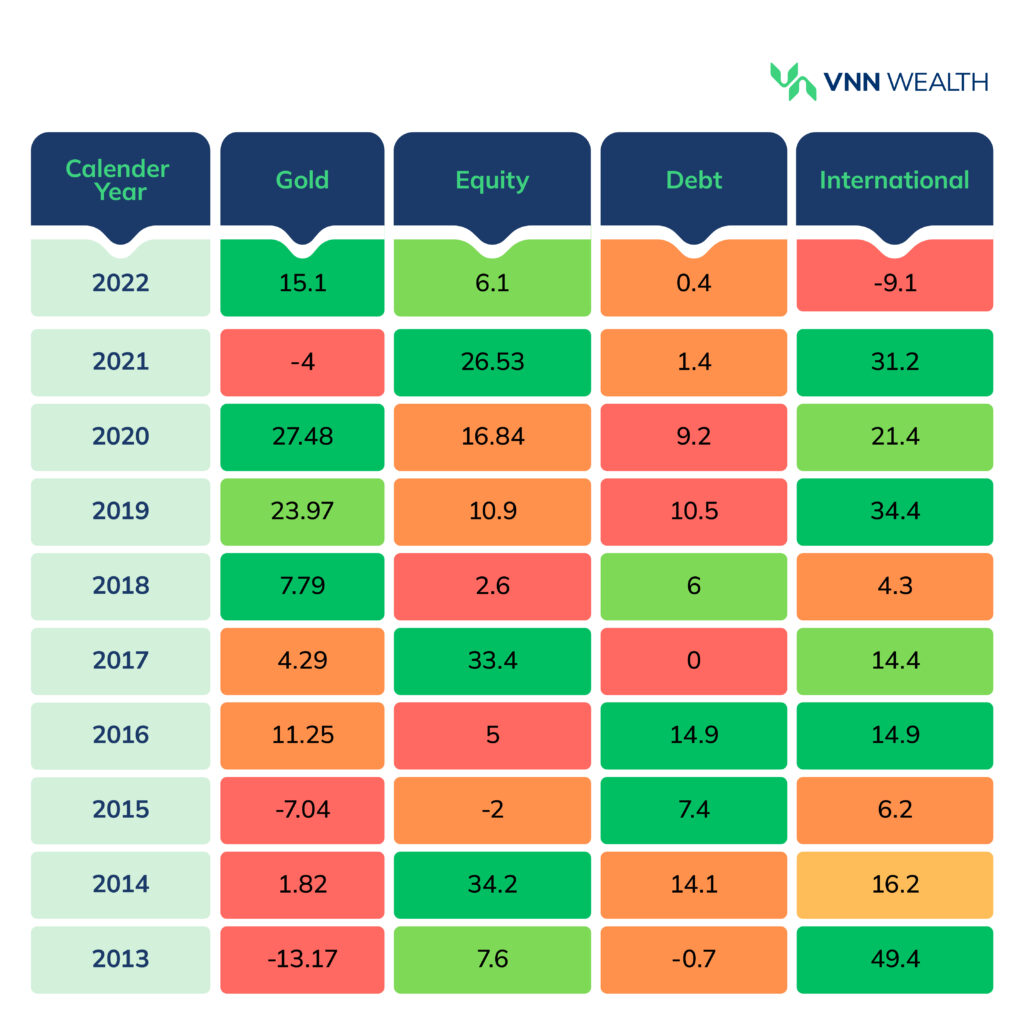

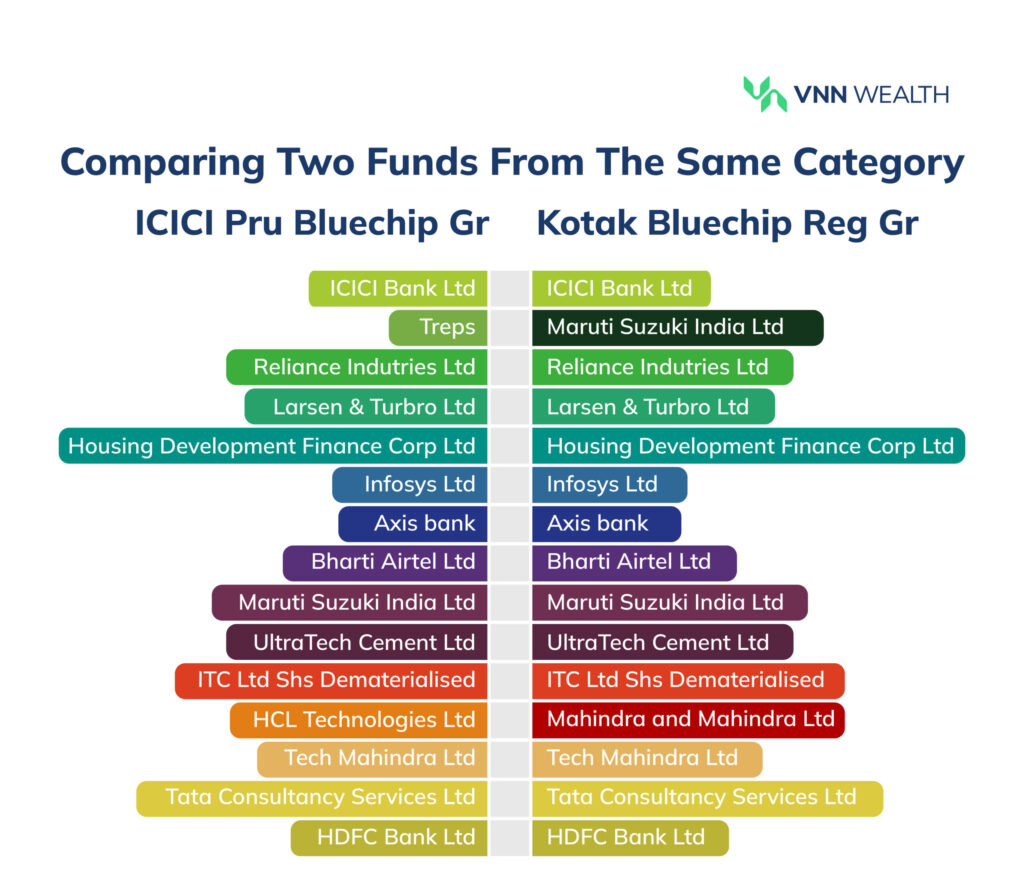

DTAA has also made it easy for NRIs to invest in Indian markets without having to worry about taxes. NRIs can invest in mutual funds and various other avenues to build wealth in India.

If you’re an NRI seeking investment opportunities in India, contact VNN Wealth. Our experts will provide detailed insights into your investment portfolio. You may like to read a step-by-step guide to filing an ITR as an NRI.