Retirement is the golden era of your life. You finally relax. Sit back in your rocking chair with a cup of tea. You have time for your family and most importantly, for yourself.

However, the ride through the retirement years will only be smooth if you plan for it beforehand.

Currently in India-

Only 10% of the 60+ population is earning from the pension or the rent.

About 60% of men and 25% of women above 60 are still working.

And 60% of the people above the age of 70 are dependants.

Planning for retirement is one of the crucial pillars of your financial journey. You spend years working hard and building wealth. That wealth should keep you afloat for the rest of your life.

So here’s how to ensure you never run out of your retirement corpus. While this blog is designed for someone nearing retirement, young investors can also learn and plan beforehand.

Know What You Want

Let’s take an example- When you visit a retail store to buy a TV, you likely have certain specifications in mind. You tell the salesperson those specifications, and they suggest options that meet your needs. But, if you’re unsure about what you’re looking for, the salesperson might try to sell you a TV on which he earns more commission.

Similarly, if you don’t know what you want for your retirement, you won’t be able to create a proper plan. Your bank RM might push a ULIP or some insurance plan that sounds good but may or may not align with your financial needs.

Therefore, it is crucial to know what you want. And how do you do that? Read along to find out everything you need to know about retirement planning.

1. Set Clear Goals

How do you want to spend your retirement? Maybe in a cozy cottage away from city life. Or annual international trips with your spouse. Everything is possible by aligning your portfolio to fulfill your goals.

But the primary step is to set a goal for your income expectations. There are multiple ways to draw a consistent income after retirement.

1. Rental income from your residential/commercial property.

2. Monthly withdrawals via systematic withdrawal plan (SWP) from your mutual funds.

3. Annuities

If you’re salaried, you might also receive a corpus built in your PF after retirement. You can strategically invest it to draw monthly income. Talk about your goals to your financial advisor. Discuss the required corpus to live a life you want to live.

Note: Explore the comparison between rental income and a systematic withdrawal plan to generate monthly income after retirement.

2. Decide a Horizon for Your Goals

At what age you’d want to retire? What would be the timeline for your goals set for post-retirement life? Give it all a thought. Talk to your spouse and children to accommodate them into your goals. That way, you can choose the investment instruments catering to specific objectives.

Here are the mutual fund categories that you can choose based on the horizon:

| Time Horizon | Fund Category |

| 0-3 Years | Debt fund/hybrid fund |

| 3 to 5 Years | Large Cap Funds |

| 5 to 7 Years | Mid Cap Funds |

| 7+ Years | Small Cap Funds |

3. Assess Your Risk Appetite

Your overall risk profile is an important factor in retirement planning. It involves analyzing your financial situation to decide how much risk you can take.

Nine out of ten times, people ignore their risk appetite. They just invest, only to find out the returns on their portfolio do not live up to their expectations. Either the portfolio is delivering low returns when a person can take higher risk. Or the portfolio is full of aggressive investments when a person has a low to moderate risk appetite.

Don’t let that happen to you. Take a risk profiling quiz to know where you stand. Answer honestly to receive insights on the asset mix that fits your profile.

4. Review Your Existing Portfolio

Your financial goals and risk appetite constantly keep evolving. Your initial investment strategy will not work for your retirement plan. Now you need a completely different strategy, which can be built against your existing portfolio.

Review your existing investment with a financial advisor. They’ll identify the gaps in your portfolio and realign it with suitable asset allocation.

5. Have an Opinion About the Market

This step is not mandatory, but it’s always good to be aware.

The market moves in a similar direction as the economy in the long run, with occasional fluctuations. So if you’re paying attention to the news about the global economy and its impact on Indian markets, you can easily form an opinion. The market awareness, at least to some extent, will help you choose the right instruments. It’ll also help you better understand your financial advisor’s suggestions to make an informed decision.

Here’s an example of how having a market opinion can help you choose the right funds:

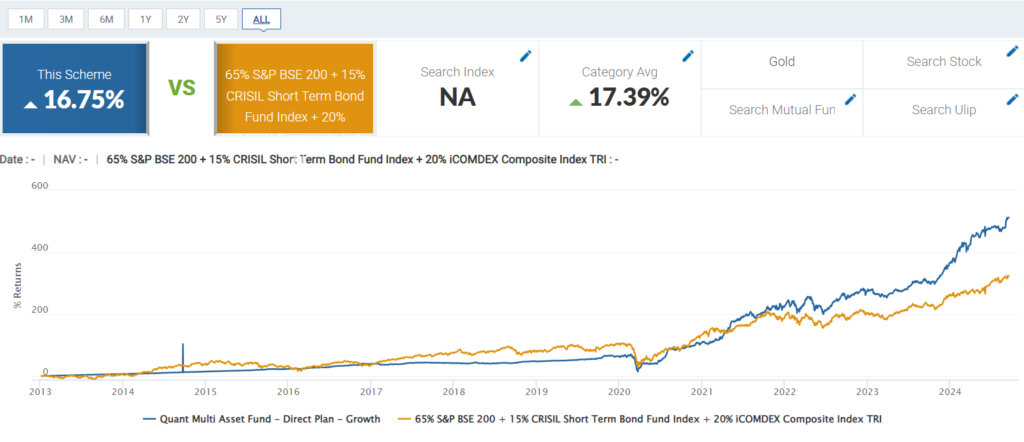

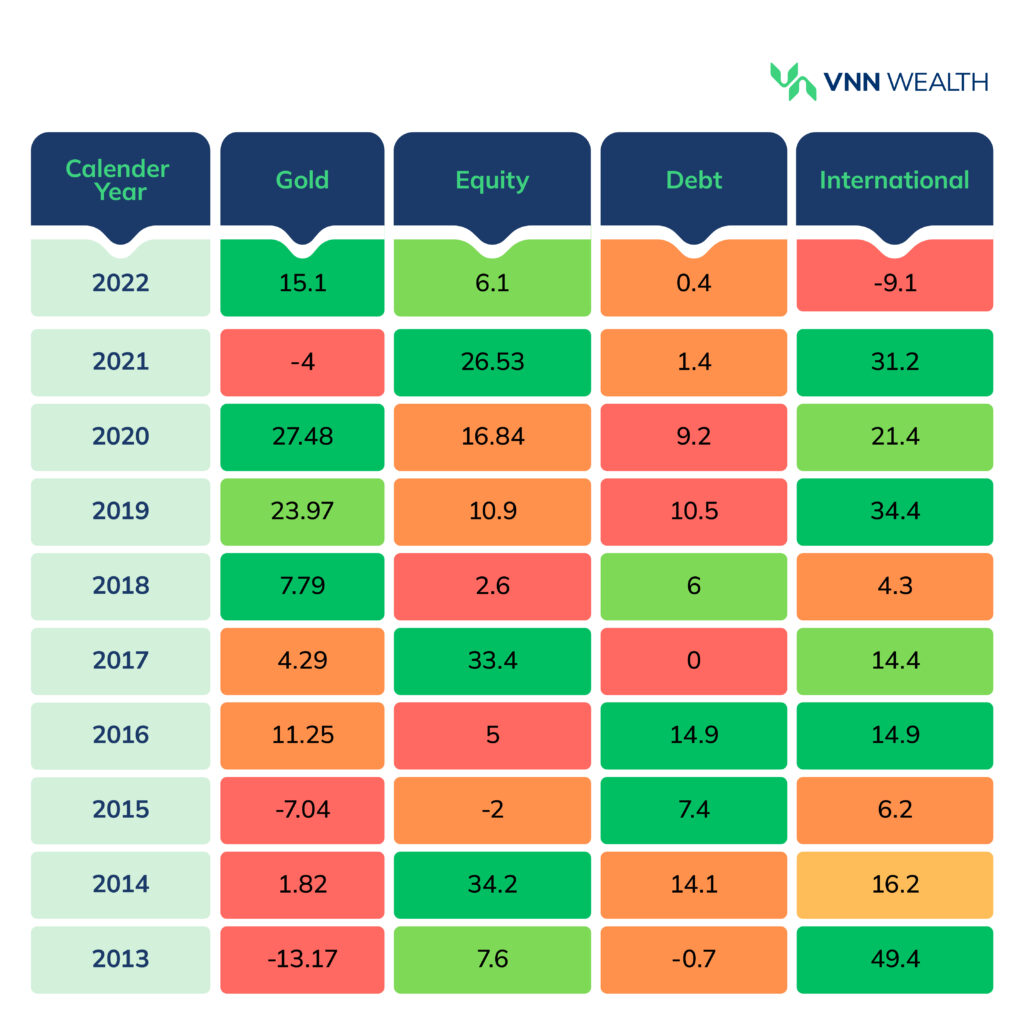

When the markets are uncertain, your focus should be on asset allocation. You can invest in hybrid funds such as Balanced Advantage Funds, Flexi Cap Funds, or Multi Asset Funds for diversification.

Each fund has a different asset allocation and a cash component to rebalance the allocation based on market scenarios. Fund houses use an inbuilt model based on various parameters for rebalancing.

1. If you think the markets are expensive at the moment and may decline: Choose balanced advantage funds with more cash holdings as these funds can buy more equity when the market declines.

2. If you think the markets will rally further, choose balanced advantage funds with more equity holding to capitalize on growth.

3. If you don’t have any opinion, choose multi-asset funds to get instant diversification across equity, debt, and gold.

Similarly, a market outlook across small-cap, mid-cap, and large-cap will help you decide which flexi-cap fund to invest in. Flexi cap funds offer allocation across market cap based on the market conditions.

5 Things to Consider While Planning For Retirement

1. Emergency Fund

Emergencies never announce themselves. A sudden expense may dent your financial plan. It’s always better to be prepared for such scenarios. Build a highly liquid emergency fund that you can withdraw whenever needed.

Make sure you have enough saved up to cover 6-12 months of your expenses. Instead of keeping these funds in your savings account, park them in liquid funds. Liquid funds offer a 1-2% extra interest rate compared to the savings account.

Buy a health insurance plan for yourself and your family. It’ll take care of your medical emergencies without draining your savings.

2. Inflation

Inflation is inevitable. Today’s INR 50,000 monthly expense would be INR 1,60,000 after 20 years with a 6% inflation rate. You will need more money to continue or upgrade your lifestyle after retirement. You can’t avoid inflation but you can certainly surpass it by optimizing your portfolio.

3. Cash Flow

While planning retirement, keep your short, medium, and long-term goals in mind. Goals are essentially your expenses. Let’s say your monthly expenses after retirement are INR 2,00,000. To plan expenses for the next 3 years, you’ll need INR 7,200,000 kept in liquid assets for easy withdrawals. The rest of your retirement corpus can be invested as per your expenses in the next 5 to 6 years or even longer as per your financial plan.

4. Estate Planning

Transferring legacy to successors is still quite common in India. If you are planning to hand over your assets to your children, you may want to plan your finances accordingly. Consider your monthly expenses and the cash flow to have a comfortable life for yourself. What’s left after that can be invested in various assets for your children to inherit later.

In order to seamlessly transfer your legacy, you must create an estate plan. Drafting a will or creating a trust avoids family disputes. It ensures the transfer of your assets as per your wishes, thereby financially securing your loved ones.

5. Taxation

Last but not least, the taxes. You have to pay tax on gains and income generated through your investments. Similar to inflation, taxes are unavoidable. However, you can dodge some taxes by optimizing a tax-efficient exit strategy. Your financial advisor will assist you with an exit strategy that ensures better post-tax returns on your portfolio.

If you don’t have a financial advisor, get in touch with VNN Wealth. Our experts will help you plan for your retirement.

Now that we’ve covered all the basics, let’s discuss the most commonly followed retirement planning strategy.

The 3-Bucket Strategy For Effective Retirement Planning

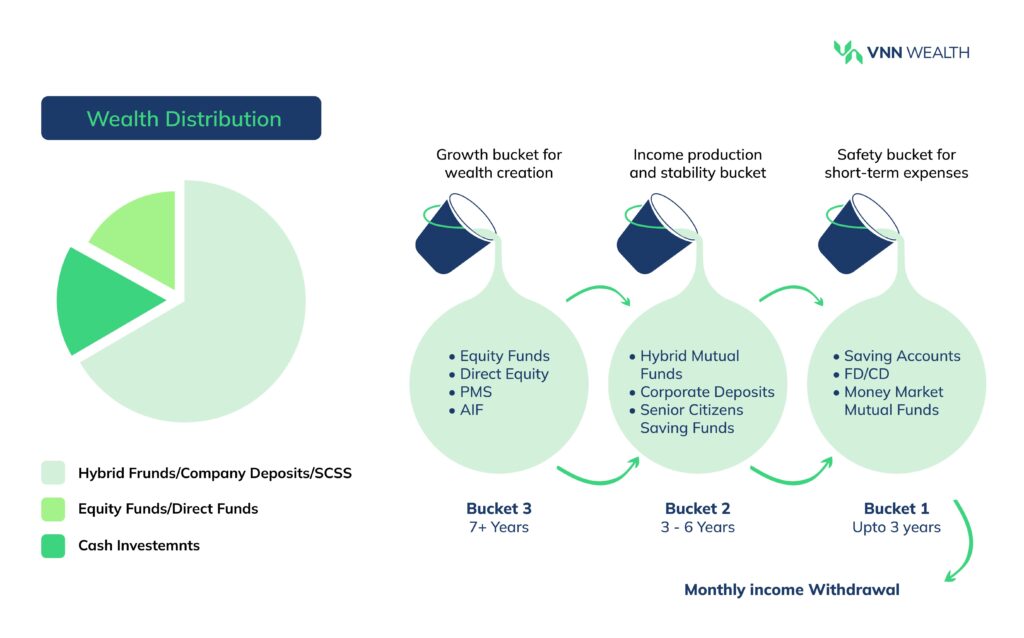

This is the most commonly followed strategy to manage your retirement corpus. The 3 buckets represent your financial needs for a particular period. Together, these buckets keep your funds moving, thereby offering you financial freedom.

Bucket #1: Short-Term Financial Goals (1 to 3 Years)

The 1st bucket, AKA Safety Bucket, contains highly liquid assets to cover living expenses for up to 3 years.

Let’s assume for the sake of example that your monthly expense after retirement would be INR 2,00,000. In that case, you can fill bucket 1 with INR 7,200,000 to comfortably cover 3 years of expenses.

Those INR 7,200,000 can be invested in high-liquidity instruments.

1. The most common liquid and safe instruments are Fixed Deposits, Certificates of Deposits, or Liquid Funds.

2. Money Market mutual funds can also be included in this bucket. These funds invest in highly liquid assets.

3. While many prefer keeping funds in savings accounts for emergencies, you can also consider short-term debt funds.

Debt funds offer liquidity, better yield than savings accounts, and are available in variable time horizons.

This bucket offers financial safety even during market downturns and avoids the need to sell long-term investments.

Bucket #2: Medium-Term Financial Goals (3 to 6 years)

Bucket 2 is a Stability Bucket for medium-term goals. The assets in this bucket cater to 3 to 5 years of financial needs.

While you are emptying the 1st bucket, investments in bucket 2 can generate interest to refill the 1st bucket.

1. Fill the second bucket with Corporate Fixed Deposits, Hybrid Mutual Funds, and Senior Citizen Saving Funds.

2. Corporate FDs are slightly riskier than bank FDs but offer superior interest rates. That extra 1 to 2% can make a huge difference.

3. Hybrid Mutual Funds invest in equity, debt, and gold. For example- Balanced Advantage Funds, Multi Asset Funds. These funds are less riskier than pure equity funds and are suitable for intermediate financial goals.

4. Senior Citizen Savings Scheme can also be a part of a medium-term financial plan. Retirees can invest INR 1,50,000 in a financial year to get an exemption on tax under section 80C of the IT Act.

The second bucket aims towards income production and stability with less volatile investments.

Bucket #3: Long-Term Financial Goals (7+ Years)

Bucket 3 is the growth bucket for wealth creation. While the first two buckets are taking care of your expenses, the 3rd bucket can keep generating more wealth. You can keep it untouched, or use the gains/capital to refill the previous two buckets.

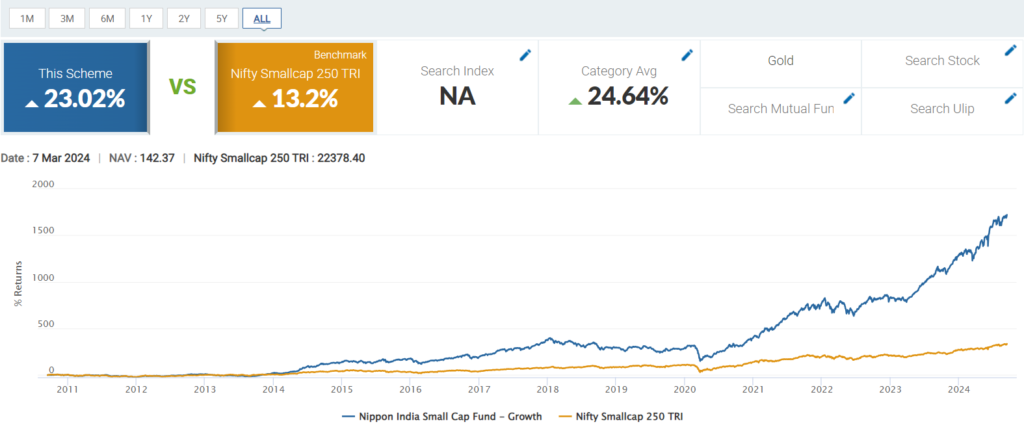

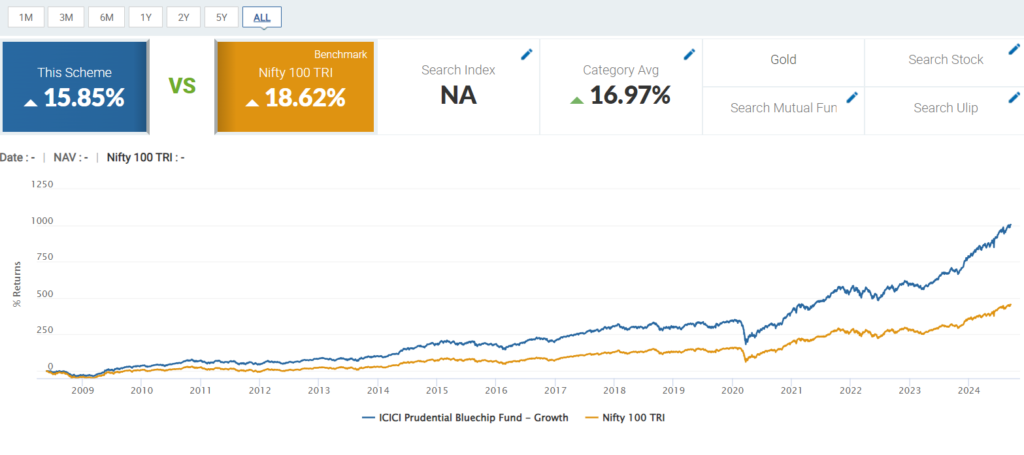

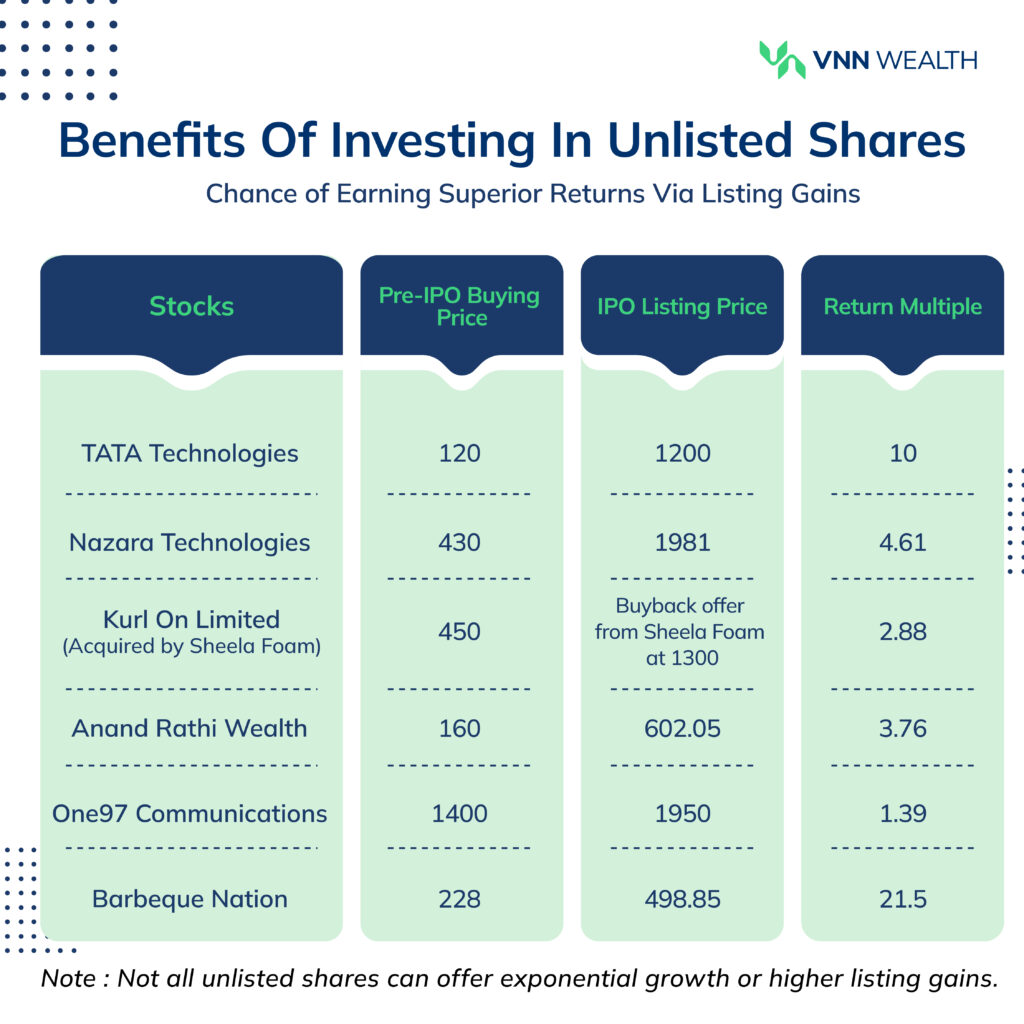

1. The best instruments to fill this bucket with are equity mutual funds, direct equity, and alternative investment funds (AIF). These instruments are capable of delivering superior returns in a longer horizon.

2. You can opt for a professional Portfolio Management Service (PMS) for a custom long-term financial plan.

Final Thoughts: How to Divide Your Retirement Corpus Into 3 Buckets?

Diving your retirement corpus into 3 buckets depends on your overall portfolio, expenses, goals, preferred investment horizon, and the income you want to generate post-retirement.

There’s no one-formula-fits-all. It’ll change as per your financial requirements and goals. The idea is to keep the cash flowing through the buckets.

If you want to manage your retirement corpus, experts at VNN Wealth will help you create a personalized 3-bucket strategy. Get your portfolio reviewed by our experts and optimize your portfolio to plan for a stress-free retirement.