Empowering Informed

Investment Decisions

Investment Decisions

Personalized wealth management solutions for business

owners, professionals, and families seeking a structured and

unbiased approach to investing.

Years Of

Experience

Countries

Served

T&C apply*

Artistic Impression

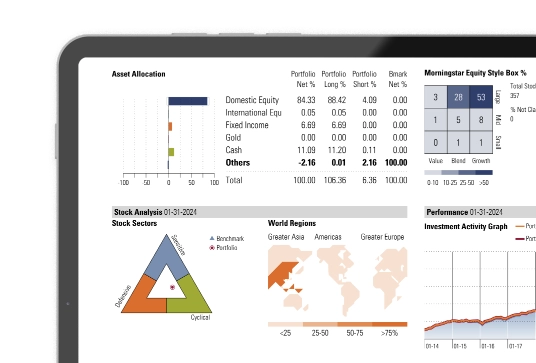

Diversify Your Portfolio

Comprehensive

Portfolio Review

Find out if your mutual fund portfolio aligns with your financial goals and risk profile. Our experts provide you with valuable insights and tailored recommendations, helping you make informed financial decisions.

Get expert guidance.

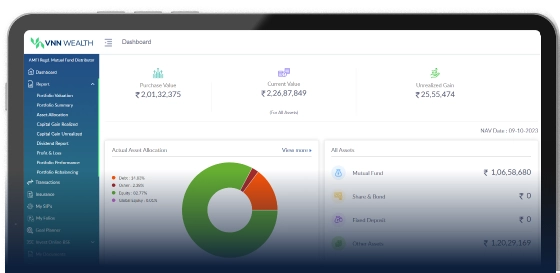

Feature-Packed Dashboard

to Seamlessly Track All Your Investments.

Zero Hassle

Streamlined Tracking

Streamlined Tracking

Convenient uploading and tracking of your Portfolio Management Services (PMS), Alternative Investment Funds (AIF), Insurance Policies, and Fixed Deposits (FD) directly on our intuitive dashboard.

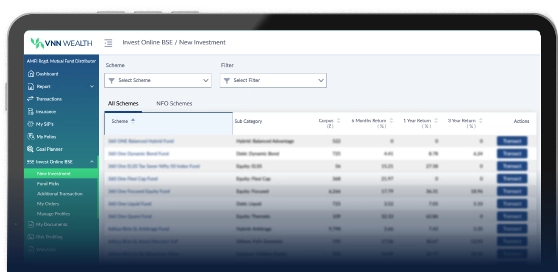

Invest Online

Explore and invest in a variety of investment options.

Invest Online

Explore and invest in a variety of investment options online. all in one place.

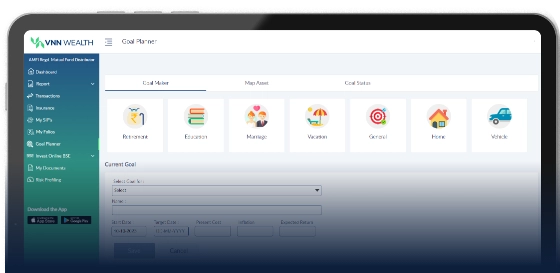

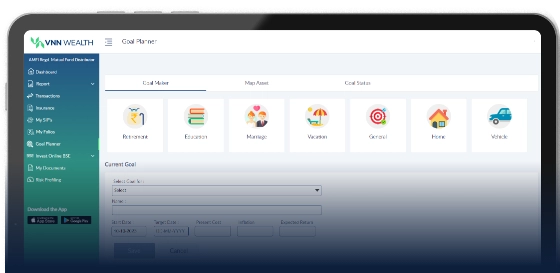

Goal Planner

Plan for life’s milestones such as Retirement, Education, Marriage, Vacation, Buying a Home/Vehicle. Allocate assets to specific goals for financial clarity.

Risk Profiling Quiz

Determine your risk profile through a series of questions to make informed investment decisions.

Risk Profiling Quiz

Determine your risk profile through a series of questions to make informed investment decisions.

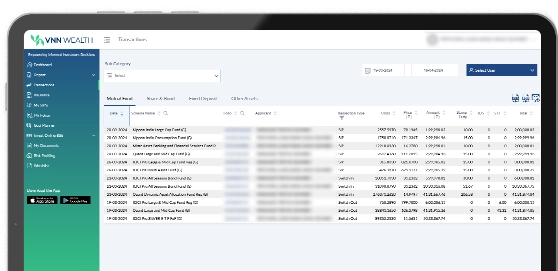

Transactions

Seamlessly track and manage all your investment transactions in one place.

My SIPs

Effortlessly stay on top of your Systematic Investment Plans (SIPs).

My SIPS

Effortlessly stay on top of your Systematic Investment Plans (SIPs).

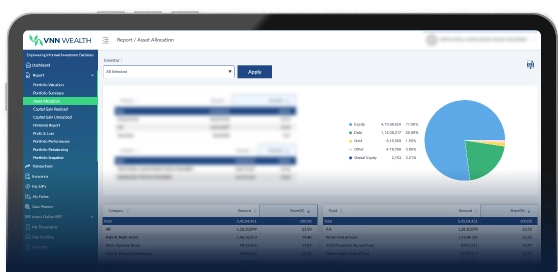

Track Asset Allocation

Monitor your portfolio's asset allocation with interactive charts and real-time value updates.

Reports

Access a suite of detailed reports such as portfolio valuation, asset allocation, realised/unrealised capital gains, portfolio performance, and more.

Reports

Access a suite of detailed reports such as portfolio valuation, asset allocation, realised/unrealised capital gains, portfolio performance, and more.

My Folios

Easily monitor and manage individual portfolios for family members.

What Our Clients Say

I’ve been investing with VNN Wealth across 3 to 4 market cycles now. Very experienced team managing my financial assets in India and I trust them with my money. Highly recommend them to anyone looking for customised investment plans or if you want a trusted financial advisor taking care of your portfolio whether you are there or not.

Balakrishnan N

Malaysia

VNN Wealth team has handled my finances for over a decade now. They are highly professional in their approach and always take into consideration my entire portfolio held with other brokers as well before recommending products and providing solutions to fill gaps in my portfolio. My wealth has grown substantially with VNN Wealth’s prompt and forward-looking portfolio advisory. Also, their rates for pre-ipo shares are very competitive.

Sanjay M

Brazil

Living in Spain and being in touch with the Indian markets becomes challenging given the time and geographic difference. VNN’s partners are always available to talk, provide regular updates on my portfolio which creates a lot of trust and sense of financial security. I trust them completely with their market knowledge as they are always up-to-date with not just Indian markets but also global economic conditions that affect Indian markets.

Dennis S

Spain

Started investing with VNN Wealth only recently. The key difference I found between them and other advisors is their scientific approach to constructing portfolios and the patience with which they answer all queries. Nothing is forcefully added in the portfolio.

Manoj R

UK

I love how from the very first meeting, the team understood my financial requirements and planned my investment portfolio around them. They spend a good amount of time explaining in detail each aspect of the financial product that my money is being invested in. Extremely prompt in their response to all my queries.

Deepak D

Singapore

I admire how VNN Wealth's partners grasped my financial needs right from our initial meeting and tailored my investment portfolio accordingly. Best financial advisors in Pune for sure.

Abida M

India

Maki and I have always been provided with the hand holding I’ve always preferred being a senior citizen. From being completely transparent to seamless execution of all plans, VNN has been my go-to for any and every financial requirement for the last 12 years now. I would say that the partners at VNN are the most patient, ethical and highly professional financial planners in Pune.

Maki and Minoo D

India

Came across very interesting opportunities in the unlisted/pre IPO space with VNN wealth. Very rare to find transparency in this space. I would highly recommend them if one’s looking for a good financial product basket mix.

Kunal C

India

Started investing with VNN Wealth only recently during COVID times. The key difference I’ve found between VNN Wealth and my other financial advisors is that their recommendations are based on how they expect the economy and various sectors to perform. This is very different from the other advisors who just come and show past performance of products and try selling them based on that. Keep up the good job guys!

Jeetendra W

India

Recent Blogs

Uncategorized

The Securities and Exchange Board of India (SEBI) has finally bridged the gap between mutual funds and PMS with a new product category- Specialized Investment Fund (SIF). It is expected to be launched by the mutual fund companies in the market by Apr

READ MORE

Blogs

The sun is shining bright on solar energy stocks in India. The green energy sector is booming as India aims to achieve 500GW capacity of renewable energy by 2030. Investing in this sector is a promising opportunity for both seasoned investors and beg

READ MORE

Blogs

Our Top 6 picks of Unlisted shares in India: 1) TATA Capital Unlisted Shares 2) SBI Mutual Funds Unlisted Shares 3) NSE India Limited Unlisted Shares 4) CSK Unlisted Shares 5) Waaree Energies Unlisted Shares 6) Studds Unlisted Shares.

READ MORE

Blogs

The number of NRIs (Non-Resident Indians) considering returning to India after retirement is rising. Those who went abroad seeking career growth are now ready to return to the warmth of their home country post-retirement. A survey conducted by

READ MORE

Blogs

Early retirement is a dream for many. In fact, one of the questions I’m often asked is, “How can I retire early and still enjoy a comfortable lifestyle?” Everyone aspires to get out of their 9-to-5 grind and enjoy a peaceful life anywhere

READ MORE

Blogs

I’m always surprised by how often people wrongly plan for their short-term financial goals. I recently met someone who invested in the Quant Small-Cap Fund. Great for the long-term, I encouraged, until they mentioned it was for buying a car w

READ MORE

Blogs

The biggest obstacle between you and your financial goals is- You! Your emotional investing is causing more harm to your portfolio than you realize. In an ever-changing financial landscape, it’s easy to let emotions influence your decision. You’r

READ MORE

Blogs

Did you know- Over 60% of civil cases in India are related to land/property disputes? Reason – lack of estate planning. Estate planning is one of the crucial pillars of your financial plan. It sets your financial affairs in order, ensures tax e

READ MORE

Blogs

So many mutual funds to invest in India. So many opinions are rolling on the internet. Where to invest? The decision is always confusing. There are more than four thousand mutual funds in India. Choosing the right funds demands plenty of consideratio

READ MORE

Blogs

How to plan for your retirement and ensure that you never run out of your retirement corpus? The 3-bucket strategy is the commonly followed strategy to manage your money after retirement. Read to know more.

READ MORE

Our Partners