Asset Allocation plays a vital role in the overall performance of your portfolio.

You know how a balanced mix of spices makes a delicious biryani? Similarly, a combination of various asset classes optimizes your investment portfolio.

Market conditions dynamically change with time. No one can predict the accurate performance of a single asset class.

The right asset allocation can hold your portfolio together during changing markets.

Read along to know more.

Asset allocation refers to distributing/allocating your money to different asset classes.

The allocation strategy ensures diversification. That way, the poor performance of one asset class can be recovered by another well-performing asset class.

Different Asset Classes Include:

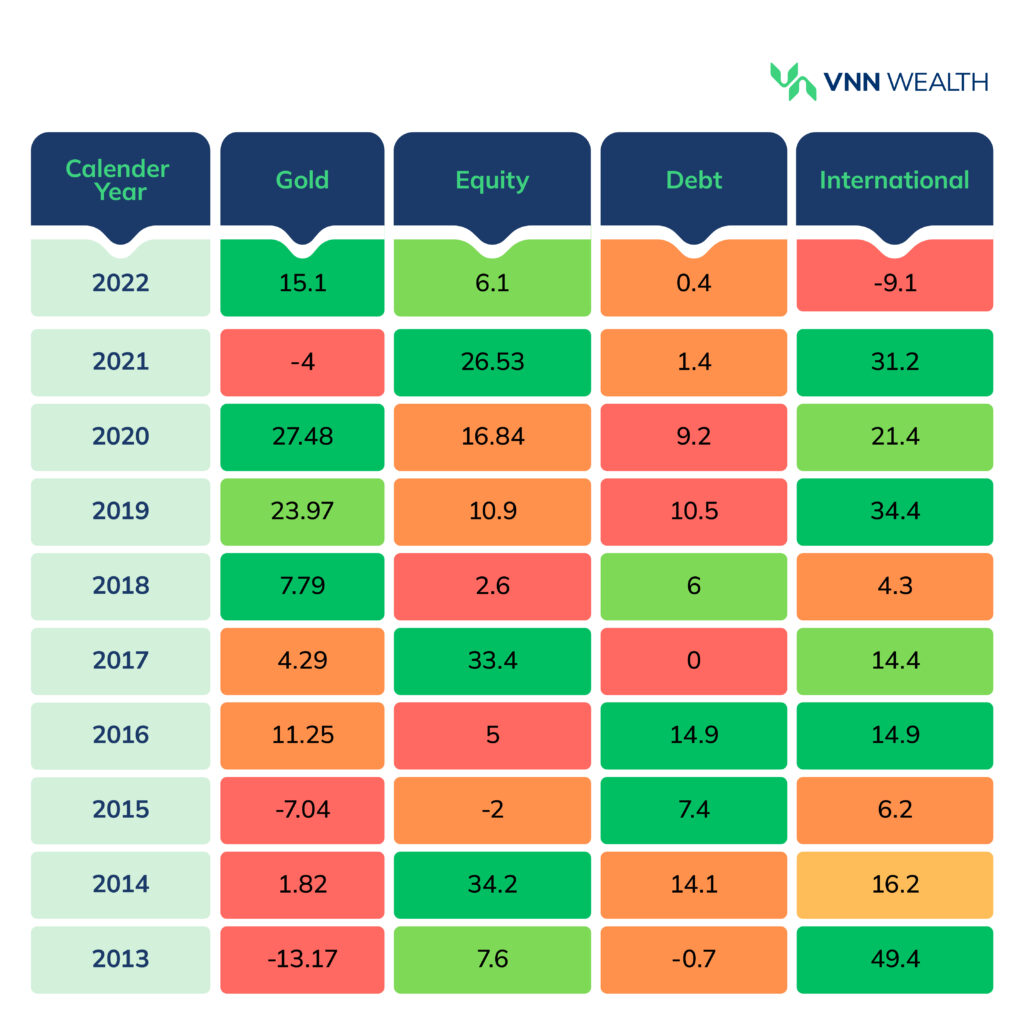

Asset allocation avoids dependence on a single asset class. Refer to the image below and you’ll notice that every asset class performs differently in changing economic conditions.

[Data Source: Bloomberg]

In the year 2021, equity delivered 26.53% returns, debt delivered 1.4% and gold was underperforming.

But in 2022, gold picked up pace and equity, debt declined by a large margin.

An equity-heavy portfolio would have delivered significant returns in 2021 but would have underperformed in 2022.

Which is why, allocation across multiple asset classes can together balance the returns.

Multiple asset classes can significantly improve your chances of earning superior risk-adjusted returns. Explore the above table again. Each asset class goes through its ups and downs every year.

An equity-heavy portfolio would have suffered in 2016, 2018, and 2019 when gold was delivering superior returns. However, a portfolio with a mix of equity, debt, and gold would deliver ideal returns considering the state of the economy at the time.

You can invest in different asset classes with variable horizons to keep your portfolio moving.

You can enter and exit mutual funds as per your preference. However, an investment horizon plays a vital role in receiving the returns you are aiming for.

Equity mutual funds usually deliver superior returns over a longer horizon. Every savvy investor would suggest you stay invested for 5-7 years or more.

And while equity investments are catering to your long-term goals, you need something liquid to withdraw quickly. Liquid funds, short-duration debt funds can be included in your asset mix for liquidity. So that, you can redeem them during an emergency.

Every asset class has different taxation rules. Asset allocation strategies also focus on lowering tax implications to maximize returns.

For example, the ELSS mutual fund is a popular tax-saving instrument offering a deduction of up to 1.5L under section 80C of the IT Act.

Hybrid debt funds with more than 35% exposure to equity still have the old indexation benefit which pure debt funds don’t have anymore.

Explore taxation on all categories of mutual funds here.

Your financial goals are easier and faster to achieve by asset allocation. It avoids confusion, prevents panic-selling during market volatility, and simplifies decision-making.

Your risk appetite, tolerance, and capacity assessment are crucial to plan asset allocation.

The risk you can comfortably manage depends upon your age, family dependency, monthly income, expenses, and more.

Evaluate your risk profile for FREE with VNN Wealth to know which asset classes fit your profile.

Asset classes may have a lock-in period or a time-frame in which they deliver ideal returns. It is crucial to ensure the expected investment horizon before entering any asset class.

All your investments essentially cater to your financial goals. You can align your investments with goals such as buying a house, funding children’s education, planning for your retirement, etc.

Strategic investments maintain a core static mix of assets. For example, if an investor wants to maintain a 65:35 ratio of equity:debt, they will periodically balance the assets to the static ratio.

Let’s say you have distributed 1,00,000 into equity:debt as 65:35%, which will be 65000 in equity and 35000 in debt.

Now assume that your equity investment went up to 1,00,000 and debt went up to 40,000 bringing the total amount to 140,000. The asset ratio became 71.4% equity and 28.5% debt.

In order to bring it back to 65:35, the equity and debt investment amount should be 91,000 and 49,000 respectively. Therefore, you’ll have to sell equity worth 9000 and allocate it to debt.

Note- You can take advantage of market opportunities to rebalance the portfolio. For example, buying more equity when equity markets are down.

Tactical asset allocation also follows a core asset mix but with opportunistic expectations.

This strategy takes advantage of market trends and timing, to maximize returns. For example, including gold/silver in your portfolio when there’s an opportunity to earn higher returns on the precious metal investments.

Another scenario is- a portfolio of 65-35% equity:debt can go to 80:20% if there’s the possibility of earning superior returns through equity for a short time. The allocation adapts to the market changes and can go back to the original formation when markets are steady.

Dynamic Asset Allocation is more of a fund-level strategy. It changes the asset mix based on the market conditions.

Counter-cyclical is a common dynamic allocation strategy in which- portfolio managers buy more equity when the markets are cheaper and sell it off at a higher price when markets correct. The debt allocation changes accordingly.

Unlike the above two strategies, here you do not have to predefine the ratio of asset mix. It can go beyond rage if the opportunity presents itself.

- Evidently, Balanced Advantage Funds follow dynamic asset allocation.

- Multi Asset Funds offer exposure to equity, debt, gold and international stocks all in the same fund.

You can explore various categories of mutual funds before sketching asset allocation for your portfolio.

Now that you know the importance of asset allocation, you can choose the strategy as per your risk appetite. Many investors like to stick to the core asset mix while others explore dynamic allocation.

A lot of investors also go with the thumb rule of age i.e. (100 - your age)% of equity allocation.

However, you must take your risk tolerance and financial goals into account.

It’s always better to start with a set of goals and plan your investments accordingly. Connect with VNN Wealth experts for more insights on asset allocation. Rebalance your investment portfolio with us.