Did you know- Over 60% of civil cases in India are related to land/property disputes? Reason – lack of estate planning.

Estate planning is one of the crucial pillars of your financial plan. It sets your financial affairs in order, ensures tax efficiency, and offers financial security for your loved ones.

Yet, people often ignore or delay it. Many think estate planning is only for the rich when in fact, it is essential for everyone.

And if you think it’s a lengthy process- it would probably demand less of your time than planning for a vacation or deciding which movie to watch or where to eat.

So, dedicate some time to an estate plan if you don’t want your legacy to go to waste.

Your planning starts here! In this blog, we will shed light on what is estate planning and various methods in India to efficiently handover your legacy.

What is Estate Planning?

An estate plan is a process of distributing a person’s assets such as property, savings, and personal belongings among his/her legal heirs after the person’s incapacity or demise. It’s a legal procedure to ensure a fair legacy transfer to the successors.

There are two ways to create an estate plan based on the complexity of your financial situation.

1. Drafting a Will

2. Creating a Trust

We will discuss both methods in detail.

But before that…

What Happens If You Don’t Do Estate Planning in India?

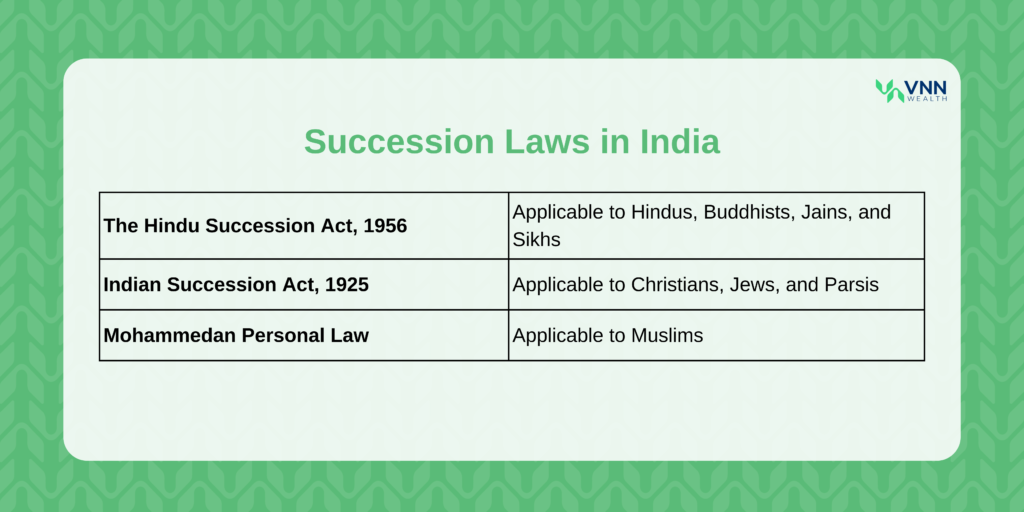

If you don’t create an estate plan, your heirs will inherit your property based on the applicable succession law.

Each succession law has defined rules about your legal and alive heirs. While these laws are created to ensure the seamless transfer of your legacy, they may not align with your preferences.

Therefore, to ensure a proper legacy handover as per your wishes, you ought to talk to your financial advisor to create an estate plan.

If you don’t have a financial advisor, you can get in touch with VNN Wealth. Our experts are happy to assist you.

Why Should You Create an Estate Plan?

To Financially Protect Your Family

Estate and succession planning isn’t only about transferring your assets to your heirs. It also includes establishing guardianship for your children (minors or children with special needs), ensuring your spouse/dependents will continue to have financial support as per your wishes.

To Minimize Family Disputes

Family disagreements are bound to happen without a predefined estate plan. The legal challenges may lead to long court battles and broken families. With a well-crafted will, you can pass on your assets as per your wishes, avoiding family conflicts.

Tax-efficient Wealth Transfer

If you’ve accumulated substantial wealth over the years, you’ll have to consider tax liability. An estate plan can offer a tax-efficient approach to transferring your assets to your loved ones. Your wealth manager can assist you in minimizing your taxes.

To Preserve Your Wealth

There are thousands of crores of assets lying unclaimed in India due to heirs not being aware of it. An estate plan will not let your assets go to waste. Set clear instructions and ensure your wealth is preserved for your family’s financial well-being.

How to Safeguard Your Financial Assets?

Joint Account

Creating a joint account with your heir while you are alive helps them understand and control your assets. The same joint account can be used to create FDs, invest in mutual funds, etc. After the demise of the primary account controlee, survivors will have to submit a death certificate to get complete control over the account.

Nominations

People confuse nomination with inheritance as everyone often adds their legal heirs as nominees. The nominee is not necessarily a legal heir. The nominee is only responsible for ensuring that your assets reach your legal heirs. You can add nominations to all your assets and change them anytime. While you can add your legal heirs as your nominee, it is recommended to add a trustworthy nominee who can take care of the handover after you.

Power of Attorney

Power of Attorney, or POA, is a legal document that gives an agent aka attorney-in-fact the authority to act on your behalf. The attorney-in-fact can make decisions regarding your medical care, finances, property, etc. The POA plays an important role in case of your absence, unavailability, or incapacity.

Married Women’s Property Act

When you buy term insurance, you aim to protect your wife and children financially. But, simply purchasing the insurance and adding nominees doesn’t guarantee financial security for your wife and children. The insurance payout could go to people you owe money to.

The solution is to purchase the term/life insurance under the MWP Act (1874). The MWP Act legally protects the insurance payout from any creditors or family members. It ensures the money goes to your wife/children. Even you, the policyholder, cannot cancel the policy without obtaining consent from the beneficiaries i.e. your wife/children. This method is ideal to protect your family especially if you have significant debt to repay.

Now, let’s unwind the methods of estate planning.

2 Methods for Estate Planning in India

Drafting a Will

A will is a legal document defining how you wish your property/assets to be distributed after your demise. It also includes clear instructions on guardianship of your children and financial security for your spouse.

You can also create a living will to outline your preferences for medical treatment in circumstances where you may not be able to convey your wishes. This includes decisions about treatments, life support, and critical care if required. A joint will is also an option where two people, usually married, create and sign a single will.

A will is created when you (the testator) are alive and can be changed any number of times. But it will only be disclosed after the testator’s demise.

Going through a probate process is mandatory for the execution of a will. It’s a court-supervised process to validate the will, settle debts, and distribute the remaining assets to the beneficiaries.

Creating a Trust

A trust is a legal arrangement in which you (the settlor) can transfer your assets to a trustee to manage those assets for the benefit of your beneficiaries. A trustee can be a person you have confidence in or an entity. Trusts are private, hence, the probate process is not required.

In India, settlors must register the trust deed under the Indian Trusts Act, 1882. It has clear instructions for the trustee to distribute the assets as per the settlor’s wish.

Appointing a trustworthy individual or an entity as your trustee is important. Their responsibilities must clearly be defined in a deed to avoid conflicts.

There are various types of trusts:

Public Trust: Created for a large group or general public. Eg: Charitable institutions, Non-profit NGOs.

Private Trust: Created for a closed group of beneficiaries such as families.

Living Trust: Created during the lifetime of a person.

Testamentary Trust: Indicates transfer of estate after the person’s demise.

Revocable Trust: Is changeable. It can be amended or terminated as per the settlor’s wishes during their lifespan.

Irrevocable Trust: Cannot be revoked after the person transfers his/her assets to the trustee.

The type of trust applicable to you depends upon your financial situation, the types and complexity of the assets.

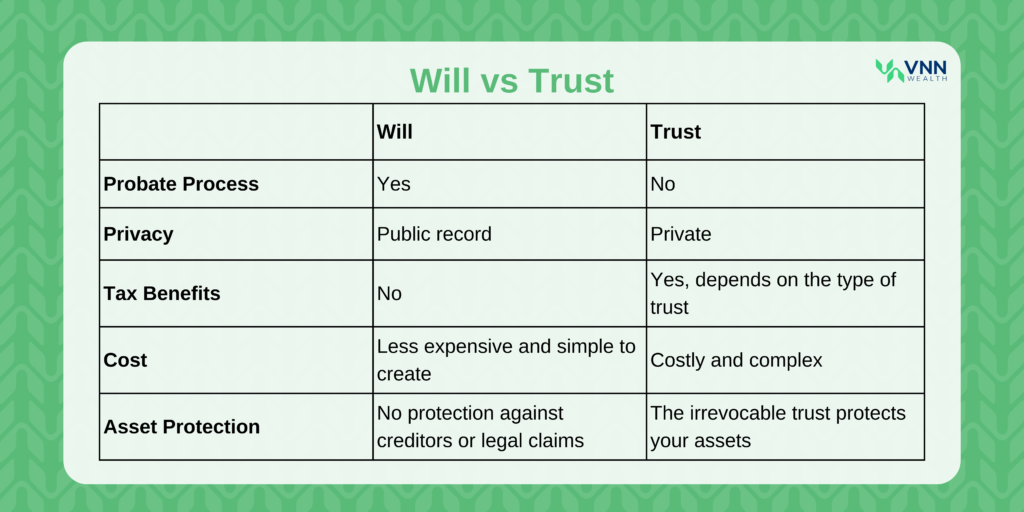

Will Vs Trust: What to Choose?

Who Should Create a Will?

A will is ideal for people with a relatively simple estate who want to distribute their assets according to their wishes. It’s a good option if you don’t mind the probate process and are looking for a cost-effective way to financially protect your family.

Who Should Create a Trust?

A trust is better suited for people with complex and large estate. It’s ideal for those who want to provide for their family under specific conditions, take care of minor children or children with special needs, and keep their estate plan private. Trusts also offer protection from creditors and potential tax benefits.

How to Prepare Your Heirs to Receive an Inheritance?

Discussing your estate plan with your heirs depends on your family dynamics. It also depends on how complex your financial affairs are. Many individuals prefer to keep their estate plan private until the right time to disclose it.

Here are certain things you can do to ensure your heirs are ready to receive an inheritance:

Financial Awareness

Your children/heirs may use your inheritance irresponsibly if they’re not financially aware. To preserve your legacy and make it last long, teach your children about savings, taxes, investments, properties, etc. Financial literacy is important if your successors are going to receive significant wealth.

Open Communication

Communicate with your family to know their preferences and opinions. Share your goals and plans with them. Make sure you and your family are on the same page. It can help you create a better estate plan.

Discuss Roles and Responsibilities

If you’re choosing one of your heirs as executor, trustee, nominee, or a power of attorney, you may want to discuss their responsibility with them. If you have minor children or a child with special needs, you can assign your family member as their guardian. Provide them with proper instructions. Train them if required and ensure they know their role.

Address Sensitive Issues

Your estate plan may have fair but variable distribution among all your heirs. In such a case, family conflicts may arise. To ensure seamless execution of your estate plan, you can address and acknowledge sensitive issues. Make them understand your decision. Change your plan if their argument (if any) is valid.

Tip: Take your financial advisor’s and lawyer’s opinion.

Final Thoughts

Estate planning is an essential aspect of your financial planning to ensure the smooth transfer of your assets. Whether you opt for a will or a trust, it’s crucial to make informed decisions based on the complexity of your estate and your family’s needs.

If you don’t create an estate plan, your estate will be distributed as per the succession law applicable to you. The law does not take your wishes into account. Therefore, everyone should have an estate plan.

You can draft a will or create a trust as per your preferences, prepare your heirs to receive an inheritance, and have open communication with your family before making your decision.

For further assistance, get in touch with VNN Wealth. Our experts will assist you with a proper financial and estate plan. Book your appointment today!