Do you ever feel like your portfolio is not growing as expected? That could be because you may have, unknowingly, made investing mistakes.

I have encountered plenty of portfolio blunders in my clients’ portfolios that go unnoticed by them. If kept unfixed, these errors can slow down your wealth creation journey.

Don’t worry! It happens to the best of us. Even the savviest investors stumble at times.

In this blog, I’m sharing some of the most common investing mistakes in India and how to fix them. Let’s dive headfirst into it…

You know how you love the butter chicken from that one particular restaurant? If you eat butter chicken anywhere else after that, you’ll compare it to the one that you loved. Nah! It’s not the same. Or, Yes! It’s pretty close to that one.

You start treating your absolute favourite butter chicken as a benchmark to compare butter chicken from every other restaurant.

Benchmark comparisons are a part of our life, especially while investing.

Yet, the majority of investors that I have met, beginners or experienced, ignore the benchmark comparison.

I’d say, benchmark comparisons are the easiest way to evaluate your mutual fund investments. Indices are clear reference points to review any fund’s performance.

You must compare funds with benchmarks such as BSE 200, NSE Nifty 50, Sensex, etc before investing and periodically evaluate them after investing.

If your fund is beating the benchmark- Great!

But a fund consistently underperforming its benchmark can be a concern. It might be a sign of poor strategy or lack of management. Keeping that fund in your portfolio will slow down your growth.

Fix: Dive deeper into why the fund is not beating the benchmark. And if required, re-allocate that money to funds in the same category that are beating the benchmark.

Imagine this. You build a nice garden in the backyard of your house. It’s gorgeous. Everyone is talking about it.

But will it stay gorgeous if you forget to water it and take care of it? No! It will soon start to wilt.

Similarly, not taking care of your portfolio, and being too hands-off with it, can be damaging.

Your portfolio shows enough symptoms to determine what’s going wrong. For example: multiple fund manager changes, significant asset outflows, and prolonged periods of poor returns.

Fix: Don’t ignore the above symptoms of a fund. You might miss out on better opportunities elsewhere. Periodically review your portfolio’s health and proactively make decisions. Make sure your portfolio is always aligned with your financial goals, risk appetite, and market conditions.

This is the most common mistake I notice while reviewing client portfolios. Stocks purchased due to some trend or a friend’s recommendation lead to too many stock holdings.

Most times, the investors are unaware of the impact this may cause. It’s one of the reasons for over-diversification, which is as bad as under-diversification.

You are lowering liquidity and losing out on investing in stocks that may deliver higher returns.

Let’s say you have invested INR 1,00,000 in 50 stocks. For the sake of example, we’ll assume the average value of each stock is INR 20,000.

Now, say, one of the stocks doubles in value (INR 40,000) with a 100% return. Amazing, right?

Wrong! Despite the 100% return on a single stock, the overall portfolio returns would only be 2%.

The ‘long tail’ of underperforming stocks can significantly lower the overall returns. Sooner or later, you’ll lose track of all the stock holdings.

Fix: Discard underperforming stocks and invest that money in stocks or mutual funds that align with your long-term goals.

I cannot stress this enough- past performance is not the only criteria to judge mutual funds.

The economy keeps changing and so does the market. The fund that performed well in the past may not deliver similar returns in the future.

Fix: Instead of only relying on past performance, focus on the key ratios of the fund mentioned in the factsheet. Look at the rolling returns. It showcases how the fund performed in changing economic cycles. Additionally, always focus on YOUR financial goals and risk appetite before choosing investment instruments.

Learn how to read a mutual fund factsheet here.

I’ve met multiple investors who believe only equity delivers superior returns. Having an equity-heavy portfolio makes sense to them.

Yes. Equity does deliver superior returns over a longer term. However, like any other asset class, equity is also cyclical in nature. In order to be a savvy investor, you must invest in various asset classes to ensure that your entire portfolio is constantly growing.

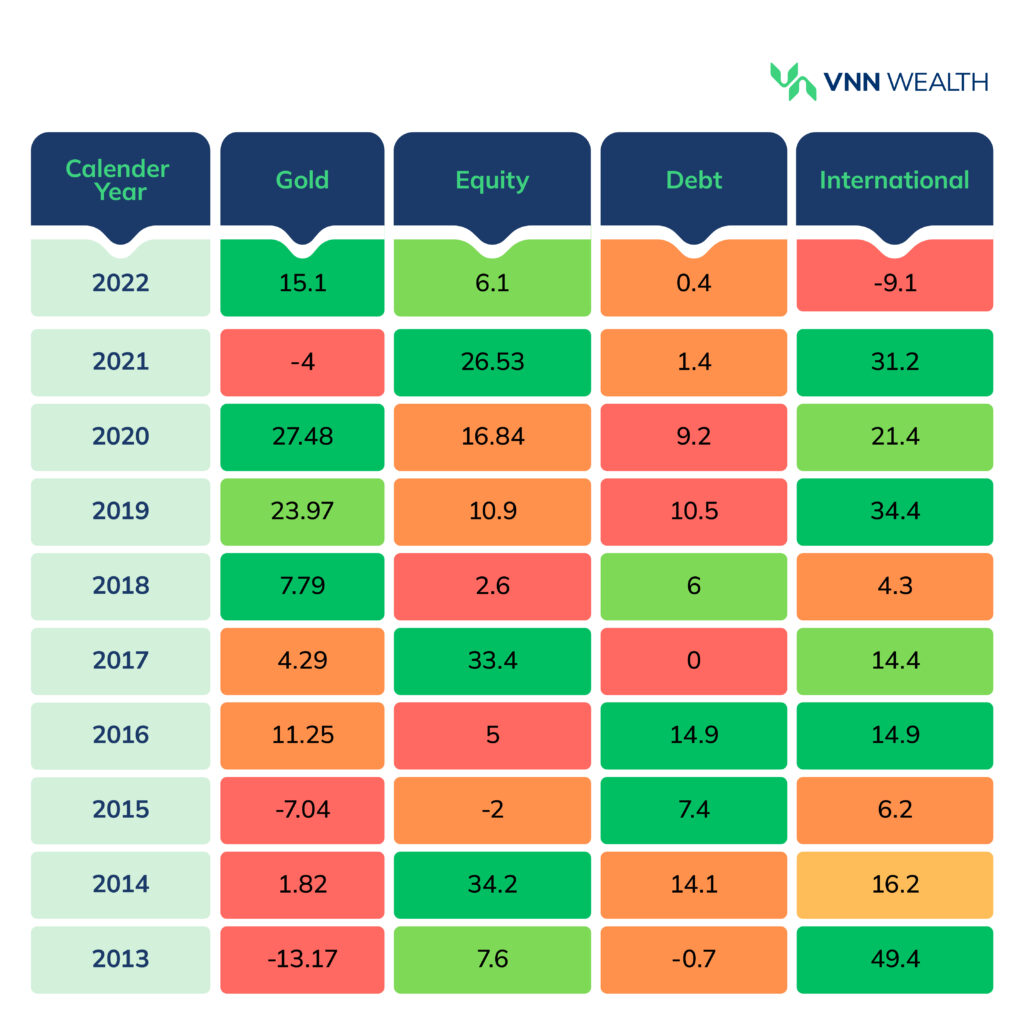

Take a look at the table below.

Each asset class has had its own ups and downs over a decade.

An equity-heavy portfolio would have delivered significant returns in 2017 and 2021. But the same portfolio would have underperformed in 2016, 2018, and 2022.

Fix: Invest across various asset classes. A balanced allocation towards multiple asset classes can deliver superior returns with downside protection. This way, when equity performance drops, gold or debt can reduce the downside risk in your portfolio and vice versa.

Read more about asset allocation here.

Have you ever been lured in by an insurance scheme that promises guaranteed returns? ‘Invest xyz per month for 7 years and earn this much for the next 8 years.’ Well…something like that.

Let me tell you, these sales pitches are amazing. They know how to make you believe in those numbers. They throw in the words like minimum risk, guaranteed earnings, and whatnot.

The best of the best have fallen for similar schemes that are nothing but slow torture. If you calculate the IRR (Internal Rate of Return) of the scheme, the overall returns are never attractive considering you’re committing to the product for a really long duration.

Fix: Don’t blindly invest in such schemes without calculating the actual IRR. You can use a simple Excel formula to calculate the IRR before you make a decision.

You might create a redundant investment if you invest in more than one mutual fund scheme within the same category.

In most cases, the underlying assets in two funds from the same category might be the same.

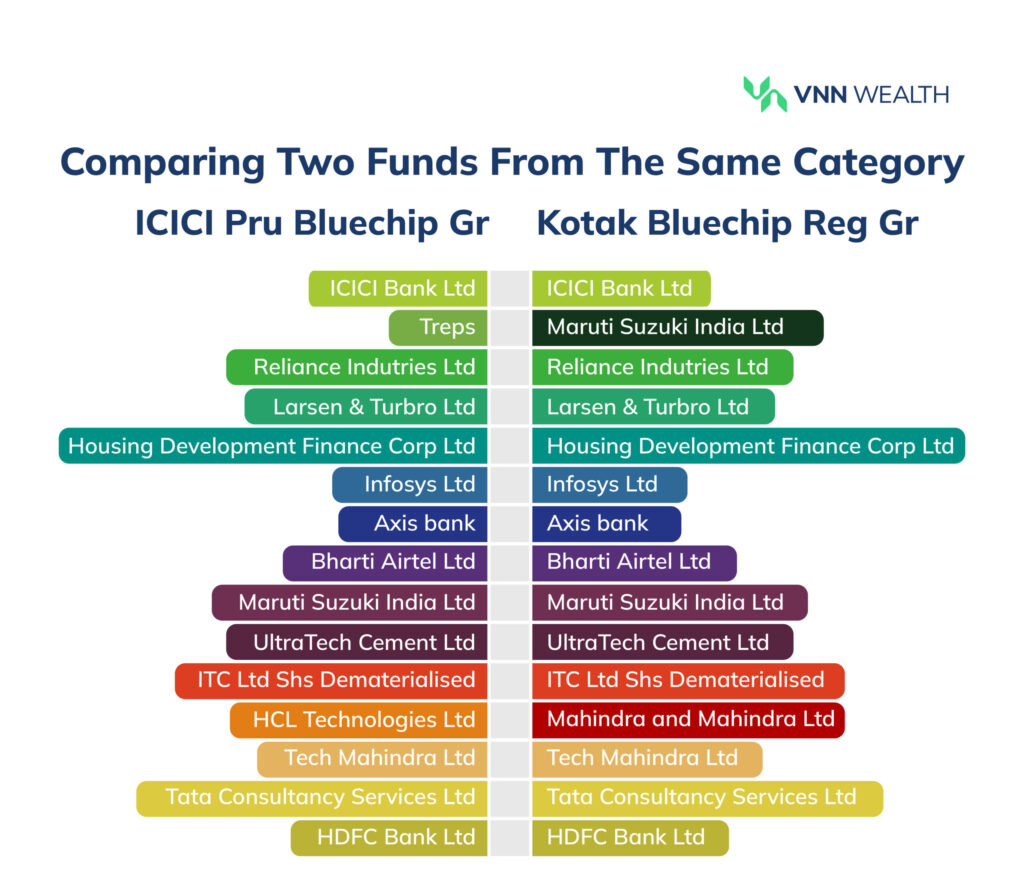

Let’s say, you’ve invested in two large-cap funds. We’ll take ICICI Prudential Bluechip and Kotak Bluechip fund as an example.

These are some of the underlying assets in both the funds:

You’ll notice that the majority of the assets in both funds are identical. This can also be viewed as a co-relation matrix, which shows that 97% of the stocks in both funds are exactly the same.

Here’s a snapshot of the correlation between multiple large-cap funds-

The degree of correlation between these funds ranges from 88% to 99%, which indicates similar underlying assets.

Fix: To ensure true diversification, invest in different categories of mutual funds or asset classes with low correlation. You can compare the factsheet of the two funds to get an idea of their top holdings. For a more detailed mutual fund comparison and an accurate correlation matrix, contact VNN Wealth advisors via our official email, Instagram Channel or LinkedIn Page.

Another common mistake many investors make is panic selling. Market volatility may cause anxiety. Understandable!

However, selling off your investments in panic is the last thing you want to do.

Let’s take the example of the 2008 global economic crisis. The Sensex had fallen by 63% from its all-time high of 21,207.

Many investors sold their investments in a panic, causing a huge loss.

If these investors had resisted the urge to panic sell and stayed invested for the next 5 years if not more; their capital would have appreciated by 115%. And about 286% in the next 10 years.

The point is, you cannot time the market. Instead of looking at small wins, focus on long-term investments.

Market volatility is inevitable but so is a market rally when the economy stabilizes. Mutual fund returns can beat inflation when you stay invested for a longer horizon.

Fix: Hold your investments for a longer horizon, especially when the markets are volatile. If you panic during a market crash, talk to your financial advisor. They will provide the necessary reassurance and guide you through the changing economic cycles.

So, there you have it- the top 8 investment portfolio mistakes you must avoid at any cost.

Building wealth is a journey that takes years. In fact, the more years you spend invested, the larger the wealth you generate.

Invest wisely. Diversify your portfolio across asset classes. Let your investments grow on auto-pilot but don’t forget to rebalance your portfolio periodically.

Reach out to VNN Wealth if you have any questions.