Risk!

It can feel like a threat for one investor and an opportunity for another.

So let me ask you this- have you ever evaluated your risk profile before investing? Kudos, if yes.

But if not, you are neglecting one of the crucial factors to consider before investing your hard-earned money.

Got 10 minutes to spare? Let’s understand your risk profile based on your risk appetite and tolerance. And while we’re at it, we’ll also discuss which investment instruments align with your risk profile.

Pour yourself a cup of tea. Let’s begin…

What is Risk Appetite?

Risk appetite is your willingness to take risks in order to generate higher returns on your investments. It’s a comfort zone where you feel safe, brave even.

Ask yourself this- what extent of risk are you willing to take without losing your sleep?

If you’re comfortable risking 40% of your investment for a short time for larger wins in the long run, then you’re an aggressive investor. Between 20-30%, you have a moderate risk appetite. And only 10% indicates you are a conservative investor.

If you can sleep peacefully, that’s the extent of risk you can take, which is your risk appetite.

However, appetite is one thing. Being able to tolerate it is another.

What is Risk Tolerance?

Let’s say you want to buy a new phone. You’ll check the specifications and features of the phone. But most importantly, you’ll check the price. Does the phone fit your budget?

Every time you buy something, you filter it out within the price range. So, even if you would want to buy a flagship phone, you’ll only do so if it fits your budget.

Similarly, you might be willing to take more risk. But does your risk-taking ability align with your will? Something to think about.

What Factors to Consider to Evaluate Your Risk Tolerance?

Many times when I review a client’s portfolio, I realize that they have misjudged their risk profile. A lot of investors believe they can invest aggressively, but they find it difficult to digest the volatility of the market or when the market enters a bear phase.

So here are some things you must consider to understand your risk tolerance.

1. Your Monthly Income and Expenses

Investors with a steady flow of income can take slightly higher risks. With income coming every month, they can consistently invest and still have money left for emergencies.

However, investors with unstable incomes will have a different risk appetite and have to invest carefully.

Your monthly income and expenses play crucial roles in your overall risk profile. Choosing the investment instruments will depend upon your risk profile.

2. Your Age

Age plays a crucial factor in determining risk tolerance.

Let’s take the example of three investors. A 25-year-old investor with years ahead to earn and invest more. A 50-year-old investor nearing retirement who has generated wealth over the years. And a 70-year retired investor managing a retirement corpus.

A 25-year-old investor can take more risk by holding the investment for years. (Aggressive risk appetite.)

A 50-year-old investor might take a slight risk, however, would prefer safer instruments. (Moderate risk appetite.)

And, a 70-year-old investor would want to keep the retirement corpus safe, hence, would go for the safest options. (Conservative risk appetite.)

As per the thumb rule of ‘100 (minus) age’% of equity exposure: The 25-year-old investor can have 75% exposure to equity. The 50-year-old investor can have 50% exposure to equity. Whereas the 70-year-old investor can have only 30% equity exposure.

However, we have met aggressive investors in the 70+ age group wanting to invest in equities. They understand the equity market and are comfortable with the risk.

It’s up to the investor’s risk appetite.

3. Your Emotional Strength

How upset would you be if your recent investment declined by 20%? Would you regret your decision or be confident about the future market rally?

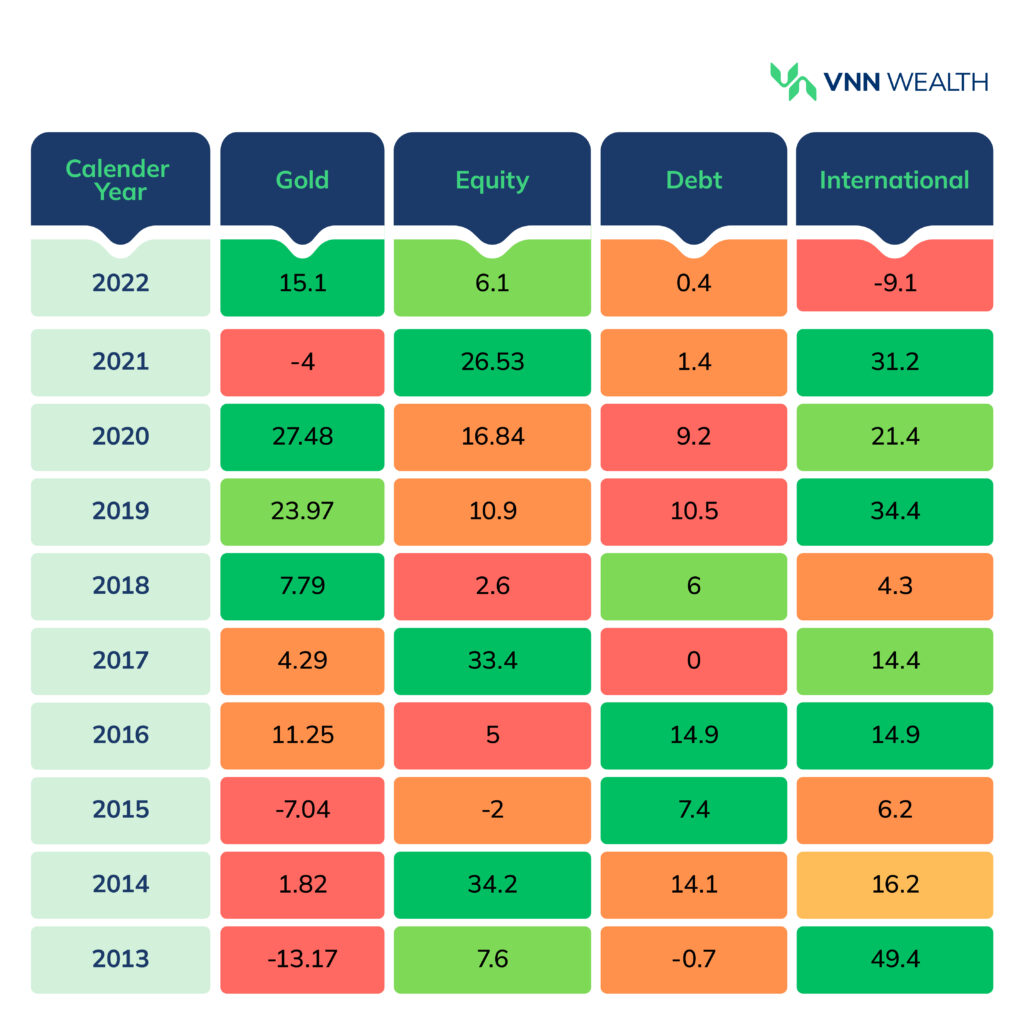

Market volatility causes many investors to panic-sell their investments. Historical data clearly shows that the market eventually bounces back from any crash. The post-COVID bull phase is the most recent example.

So, if you panic during a market crash, you might be either a conservative or a moderate investor. An aggressive investor might invest more during a market crash.

4. Your Investment Horizon

Your investment horizon decides how aggressive or conservative you want to be. For example, say you want to park your money for the next 3 to 6 months. For a timeframe that narrow, you’d prefer safer avenues such as liquid funds, short-term debt funds rather than equity investments.

Similarly, if you can stay invested for 5+ years, you can consider high-risk investments. A longer time horizon can mitigate the risk. The economy is bound to grow, making the investment less risky.

What is a Risk Profile?

A risk profile is a collective verdict of risk appetite and tolerance. Your risk profile indicates where you should/can invest to fulfill your financial goals.

So…the moment of truth:

Invest as Per Your Risk Profile

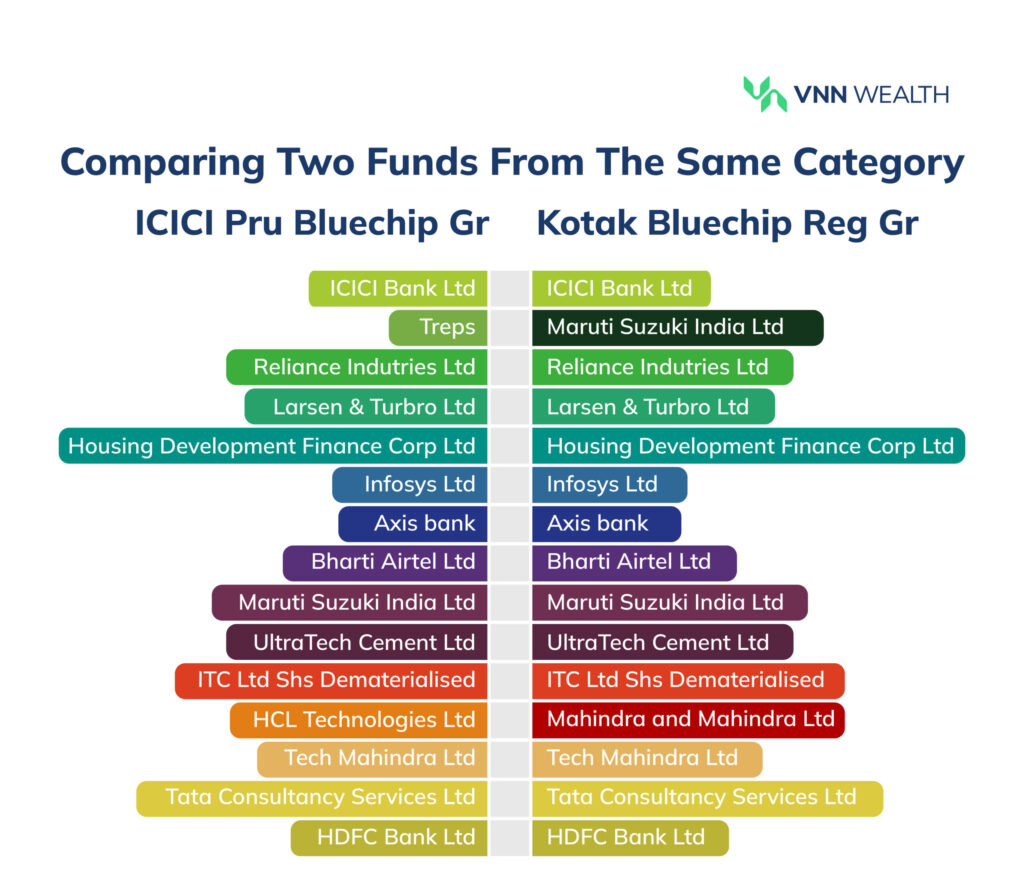

Aggressive Investors can invest in: Pure equity mutual funds, Direct equity, Emerging sectors via sectoral funds, Thematic Funds, Alternative Investment Funds, Unlisted Shares etc. And to manage all that, you can also opt for Portfolio Management Services.

Moderate Investors can invest in: Hybrid funds such as the Balanced Advantage Fund, and the Multi Asset Fund. A small percentage of pure equity funds would contribute to the portfolio growth.

Conservative Investors can invest in: Various types of debt funds, Fixed Deposits/Corporate Deposits, Public provident funds, etc.

The above categories are just for reference. You must also factorize your time horizon and financial objectives.

For example, if you are investing for a short-term goal (say 6-12 months), then investing in pure equity won’t make sense even for aggressive investors.

Similarly, conservative investors with 5-10 years of investment horizon can look at hybrid funds or large cap funds instead of FDs or debt funds.

Final Thoughts

Risk profiling, a very crucial first step, will give you an idea of the investment instruments you can look at.

The next step is to finalize your financial goals. It will help you filter out the instruments with the appropriate time horizon.

Your risk profile and financial goals may change with time. Therefore, you must periodically evaluate and rebalance your portfolio.

If you want to review your portfolio and calculate your risk profile, experts at VNN Wealth can assist you. Get in touch with us. Or schedule a finance consultation call at your convenience.