So many mutual funds to invest in India. So many opinions are rolling on the internet. Where to invest?

The decision is always confusing. There are more than four thousand mutual funds in India. Choosing the right funds demands plenty of considerations. It includes analyzing your existing portfolio and exploring the current economic growth.

The performance of mutual funds changes due to various factors. Investing in mutual funds based on their rating or past performance is not a smart decision.

Then what is?

That’s what we’ll discuss in this blog. Instead of choosing mutual funds to invest in 2024, we will talk about the categories of funds that’ll perform well in the coming years.

But before that, let’s understand the global economy

Global Economic Conditions

The global economy is facing an uncertain volatile time due to a combination of geopolitical conflicts. As the economy was recovering from the COVID-19 pandemic losses, the Russia-Ukrain war caused another disruption. It significantly impacted the supply of essential commodities like oil, gas, and agricultural products. Therefore, gas and oil prices have inflated in many countries, particularly in Europe as it depends on Russian energy sources. The war also caused fluctuations in steel, palladium, and aluminum markets, thereby increasing the cost.

Other geopolitical conflicts such as tensions between Iran and Israel, and instability in Bangladesh, are increasing global uncertainty. Moreover, China is also showing signs of a slowdown which could impact demand for raw materials thereby fluctuating the commodity prices. Weak GDP numbers have caused Chinese stocks to decline. China’s equity barometer, the Shanghai Composite fell 3.3% in Aug 2024.

Japan is facing a Yen carry trade issue as the Bank of Japan raised the interest rates from 0.10% to 0.25%.

One of the advanced economies, the USA, is also facing economic volatility due to the possibility of a recession, increased rate of unemployment, and disappointing corporate profits. The US equities declined sharply at the beginning of Aug’24, but the market recovered by the end of the month. The major indices of the US- S&P 500 and Nasdaq 100, rallied by 2.3% and 1.1% respectively.

All these geopolitical events are causing uncertainties in markets worldwide. Now let’s take a look at how Indian markets are performing amid these conflicts.

Indian Market Outlook

Fortunately, the Indian economy is booming. Industries like Pharma, Solar, and Tech, are significantly contributing to the economic growth.

Power demand is rising. Credit growth is expanding. Banking and Corporate sectors are rallying up. And not to mention, we have one of the best macros in the world.

Between Sept 2023 and Sept 2024, the Nifty 50 grew by approximately 26.49% and Sensex grew by 23.17%.

Around July and August 2024, the Yen carry trade issue and the US slowdown caused a slight decline in the equity markets. However, we’re currently in the liquidity bull run. Therefore, the impact wasn’t as significant as it would have been.

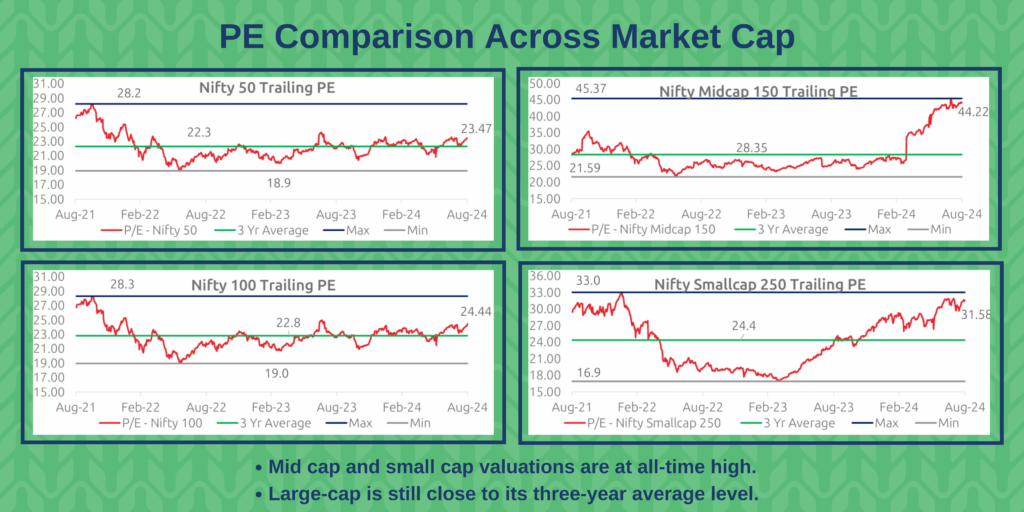

If you take a look at the charts above, the mid-cap and small cap valuations are expensive compared to large-cap at the moment. While mid-cap and small-cap are at their all-time high, the large-cap is still close to its three-year average level.

The long-term India Growth story remains intact. However, the global economic crisis is bound to have an impact on the Indian economy.

So then how do you ensure portfolio growth while dodging the market uncertainty?

The answer is- Asset Allocation!

What is Asset Allocation?

Asset allocation refers to distributing your money across various asset classes such as equity, fixed income, gold, real estate, international equity, etc.

Asset allocation is crucial to avoid dependence on the single asset class. That way, when one asset class is going through a decline, the other asset class can maintain the balance of your portfolio.

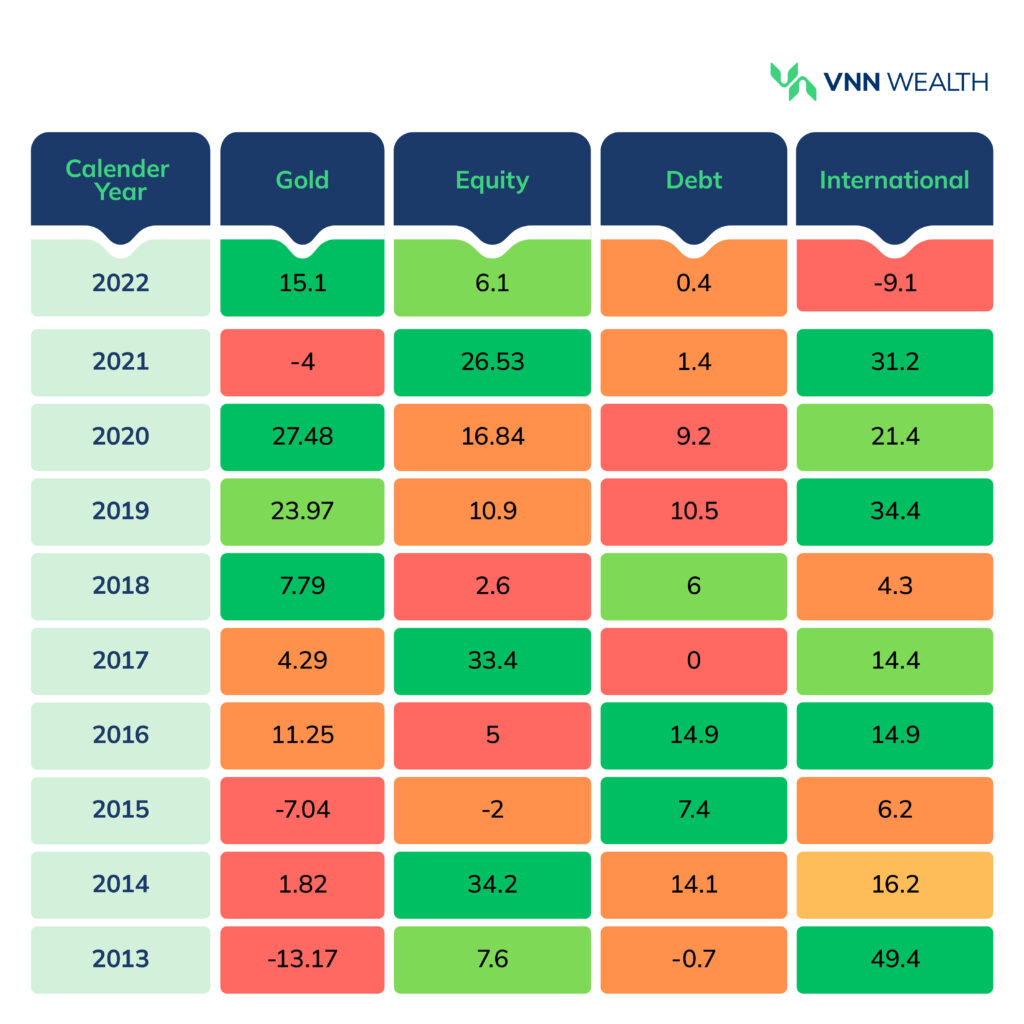

Take a look at the table below. As you can see, asset classes are never in sync. For example, in 2020, gold performed better than equity and debt. However, in 2021, equity significantly outperformed gold.

An ideal mix of all assets offers a perfectly balanced portfolio.

Now let’s move on to the mutual funds to invest in 2024 considering the market outlook. Your focus should be on the asset allocation. Below are some of the fund categories that can strengthen your portfolio amid global economic changes.

Best Mutual Funds to Invest in India in 2024

1. Dynamic Asset Allocation Fund (AKA Balanced Advantage Fund)

These are hybrid funds with a mix of equity and debt. Balanced Advantage Funds invest 65-80% of total assets into equity and 35-20% in debt.

Fund houses use valuation metrics such as the Price-to-Earnings (P/E) or Price-to-Book (P/B) ratios of indices like the Nifty or Sensex to strategically adjust equity/debt exposure. For example, increasing the equity exposure when the market corrects to capitalize on the discount. Or increasing the debt exposure by selling equity when markets are overvalued.

Considering the current market scenario, BAFs are ideal for balancing equity and debt exposure. Instead of deciding the allocation by yourself, you can invest in BAFs and let the fund manager handle it for you.

The risk-return ratio on these funds varies based on allocation. Some BAFs are aggressive with the majority of the allocation to equity. Whereas conservative BAFs provide a debt-fund-like experience with some exposure to equity for growth. Choose the fund that fits your preference.

Some of the BAFs that you can look at are:

1. ICICI Prudential Balanced Advantage Fund

2. Kotak Balanced Advantage Fund

3. Quant Dynamic Asset Allocation Fund

4. SBI Balanced Advantage Fund

BAFs are ideal for investors seeking equity growth with lower risk. Fund houses leverage the equity market movement to generate superior returns. The debt component balanced the volatility and reduced the risk.

2. Multi Asset Funds

Multi asset funds are also hybrid funds with exposure to equity, debt, and gold. These funds offer instant diversification across three different asset classes.

These funds offer at least 10% exposure to each asset class. Most multi asset funds are equity-oriented with at least 65% exposure to equity to make them tax-efficient and the remaining exposure to debt and gold.

While equity will contribute towards the growth of this category, gold is playing its role better than ever. This year (YTD2024), gold has surpassed the Sensex by delivering 16% year-to-date returns. If the global economic conditions continue to fluctuate, gold will emerge as a safety net. Therefore, having exposure to gold is beneficial for your portfolio’s overall growth.

Multi asset funds have become investors’ preferred choice. These funds efficiently navigate market volatility by diversification. Ever since the debt fund taxation changed, these funds have gained more popularity. The AUM for multi asset funds has nearly doubled between March 23 to March 24. You can invest in debt with equity taxation, making these funds more attractive.

Multi asset funds are ideal for investors with conservative to moderate risk appetite.

Here are some of the MAFs you can consider:

1. ICICI Prudential Multi Asset Fund

2. Kotak Multi Asset Fund

3. Quant Multi Asset Fund

3. Flexi Cap Funds

Flexi cap funds provide flexible asset allocation across the market capitalization and sectors/themes. Currently, small-cap and mid-cap segments are expensive whereas large-cap is fairly valued as shown above in the Indian market outlook. Instead of wondering where to invest, flexi cap offers a healthy blend of all three categories.

Unlike multi-cap funds, flexi cap funds have no restrictions on market cap. Fund houses use various value-based, risk-adjusted strategies to shift allocation across the market cap. These strategies jump on the market opportunities to maximize returns.

The risk factor for these funds may vary based on the exposure across the market cap. Do check the current allocation of the fund before investing to see if it matches your risk appetite.

These funds are ideal for moderate investors to build wealth over a long horizon.

Here are some of the flexi cap funds to explore:

1. HDFC Flexi Cap Fund

2. Quant Flexi Cap Fund

3. Motilal Oswal Flexi Cap Fund

4. JM Flexi Cap Fund

4. Large Cap Funds

Over the last three years, large cap segment has been appropriately valued. The category has been lingering around the three-year average return level. In the coming years, fresh inflows from FIIs and DIIs are most likely to chase large cap category because of its relatively fair valuation.

Small and mid cap funds, being aggressive, are ideal for 7+ years of investment horizon. Whereas large-cap can cater to your 5-year financial goals. Large-cap funds are suitable to balance the volatility of small or mid cap funds in your portfolio. These funds are specifically suitable for new investors wanting to explore equity market. Start with large-cap then gradually explore small and mid cap funds.

Here are some of the large cap funds to view:

1. Nippon India Large Cap Fund

2. Quant Large Cap Fund

3. ICICI Prudential Bluechip Fund

4. HDFC Top 100 Fund

Factors to Consider Before Investing in Mutual Funds

While the market outlook is important to craft your portfolio, there are various other factors to consider.

1. Your Financial Goals and Their Timeline

Setting clear goals and desired timelines helps optimize your portfolio. For example, if you’re planning to invest for a longer horizon, maybe to buy a home, you can invest in the aggressive scheme. Because risk is more associated with time than the scheme itself. Time mitigates risk.

On the contrary, if you’re planning for a short-term goal, for example buying a car, opt for safer funds. Debt funds or hybrid funds are ideal in such scenarios.

Allocate funds to your goals. That way, you’re not bothered by the market movements. All you have to do is stick to your investment strategy and time horizon.

Your financial advisor can help you create a strategy as per your goals. If you don’t have an advisor, you can book an appointment with experts at VNN Wealth to build your portfolio.

2. Your Risk Appetite

Take a risk profiling quiz to analyze how much risk you are comfortable in taking. The quiz will evaluate your financial as well as behavioral aspects to determine the suitable asset mix.

Your risk profile is a crucial factor in determining ideal mutual funds for you. If you’re an aggressive investor, you can explore aggressive categories. Otherwise, a balanced asset allocation is a way to go.

3. Your Existing Portfolio

All the categories we mentioned above are suitable for both new and experienced investors. However, an experienced investor must review their existing portfolio to ensure true diversification.

A portfolio review will not only identify a gap in your portfolio but also avoid redundancy. Evaluate your investments with respect to your current financial situation and your goals. Our experts will also help you with the tax-efficient exit strategy to realign your portfolio.

Conclusion

Investing in mutual funds needs a strategic approach. You have to consider both the economic conditions and your financial goals. With the global economy facing uncertainties due to geopolitical tensions and market volatility, an optimized asset allocation strategy can offer stability and growth.

Currently, the best mutual funds to invest in India are Balanced Advantage Funds, Multi Asset Funds, Flexi Cap Funds, and Large Cap Funds. These funds help mitigate risks and capitalize on market opportunities.

While choosing the funds to invest, don’t chase past performance. The market may or may not replicate past success as the economy keeps changing, sectors are cyclical in nature and keep moving up and down. What may have worked for one fund in the past may not necessarily work in the future. Read the mutual fund factsheet instead to understand the allocation, rebalancing model, risk factor, etc.

Aligning your investments with your risk appetite, financial goals, and time horizon. Focus on diversifying your portfolio to navigate the changing economic landscape. Talk to an expert to further strengthen your portfolio and ensure long-term growth. Get your portfolio reviewed by our experts to receive personalized investment opportunities.