Investing in mutual funds is as easy as ordering your favorite shoes online.

The financial awareness has increased and so are the number of mutual fund investors. Anyone can start investing with as little as INR 100/month via SIP. Mutual funds can accompany you throughout your wealth-creation journey. And if you want that journey to be smooth, you must incorporate certain practices.

In this blog, we will cover some of the common dos and don’ts of mutual funds. Let the learning begin…

What You Should and Shouldn’t Do with Mutual Fund Investments

Below are some factors to keep in mind as an informed mutual fund investor.

Dos of Mutual Funds

1. Understand the Fund Objective

Mutual funds have various categories primarily divided into equity funds, debt funds, or hybrid funds.

Equity funds invest in company stocks across the market cap. Debt funds are a collection of government bonds, corporate bonds, T-bills, etc. Hybrid funds are a combination of both.

Each fund has a different composition, category, and associated risk. You can read the mutual fund factsheet to understand the fund objective before investing in it.

2. Evaluate Your Risk Appetite and Create Financial Goals

Investing in a fund that doesn’t fit your risk appetite is like buying the wrong size of shoes.

The easiest way to understand your risk appetite is by evaluating your income and expenses. Whatever money you are left with after expenses can be invested.

Here, you may want to consider your ability to take risk instead of willingness.

You may like to read-> Invest as per your risk appetite.

Once you understand your risk appetite- define short, medium, and long-term financial goals. For example, buying a car, moving to a bigger home, etc.

Your risk appetite and financial goals collectively help you plan your investment across mutual funds.

3. Establish Consistency via Systematic Investment Strategy

Consistent investments can help you achieve your financial goals faster. Systematic Investment Plan (SIP) is a popular strategy for consistent investment.

You can start an SIP of 100/month, 500/month, 5000/month or whatever amount you are comfortable with.

Benefits of Investing via SIP.

4. Review Tax Implications

Investors have to pay tax on capital gains earned from mutual funds. Equity mutual funds, debt mutual funds, and hybrid mutual funds have different tax implications.

Short-term capital gains will be applicable on investments withdrawn before 12 months for equity funds and before 36 months for debt funds. Whereas, equity investments redeemed after 12 months and debt investments redeemed after 36 months will fall under long-term capital gain taxation.

Here’s a quick overview of mutual fund taxation rules for Indians and NRIs.

5. Regularly Monitor Your Investments

Your income, financial goals and risk appetite will change with time. Update your investments accordingly.

You can consider increasing the SIP amount, changing asset allocation, and redefining your financial goals.

Regular portfolio monitoring also helps you restructure mutual fund categories that you’ve invested in.

Don’ts Of Mutual Funds

1. Don’t Follow The Crowd

Your financial expectations, goals, and horizon will always be different than someone else’s. Just because a friend invested in a certain fund doesn’t mean you should too.

Investing based on other’s opinions might do more harm than good to your portfolio. Instead, consider hiring a wealth manager/financial advisor who can sketch a portfolio of funds for you.

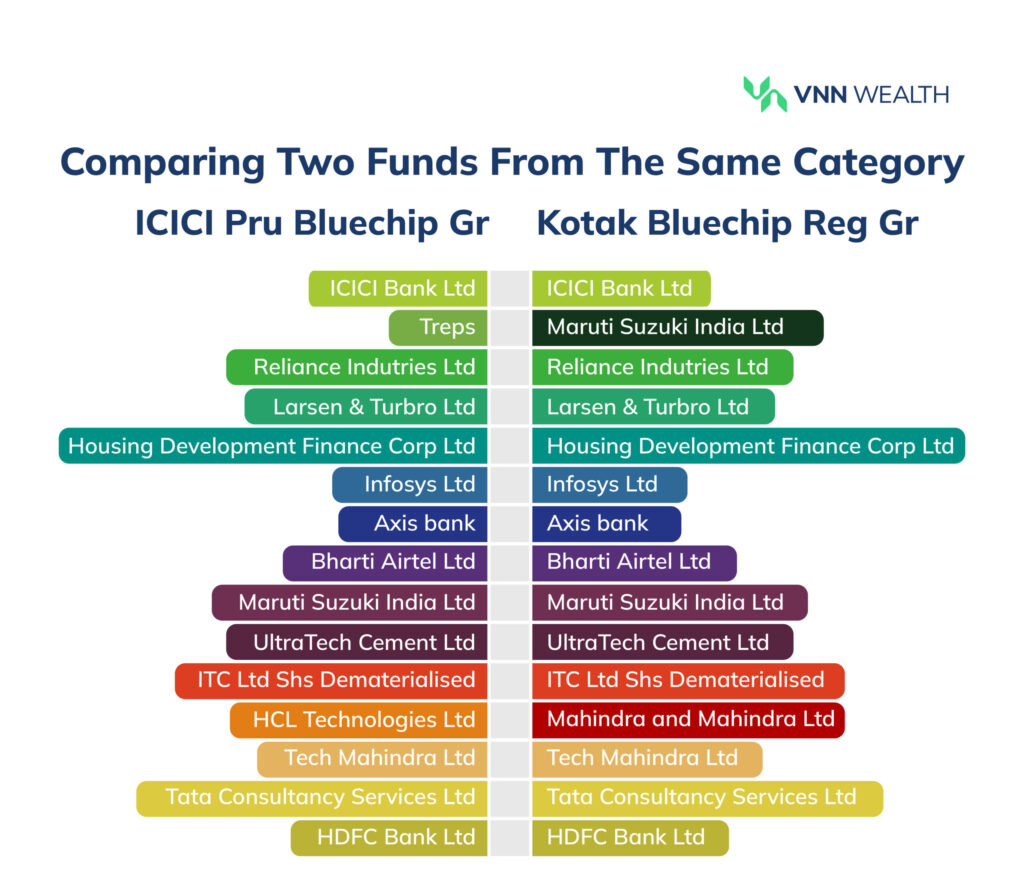

2. Don’t Choose Funds Based on Past Performance

A lot of investors make the mistake of choosing funds based on past performance. The fund’s history has very little to do with its future performance.

Mutual fund past performance guarantees nothing. It only showcases the consistency of the fund during changing economic cycles.

The better way to judge a fund is by checking the underlying assets, the fund manager’s track record, and the rolling returns of the fund with respect to the benchmark.

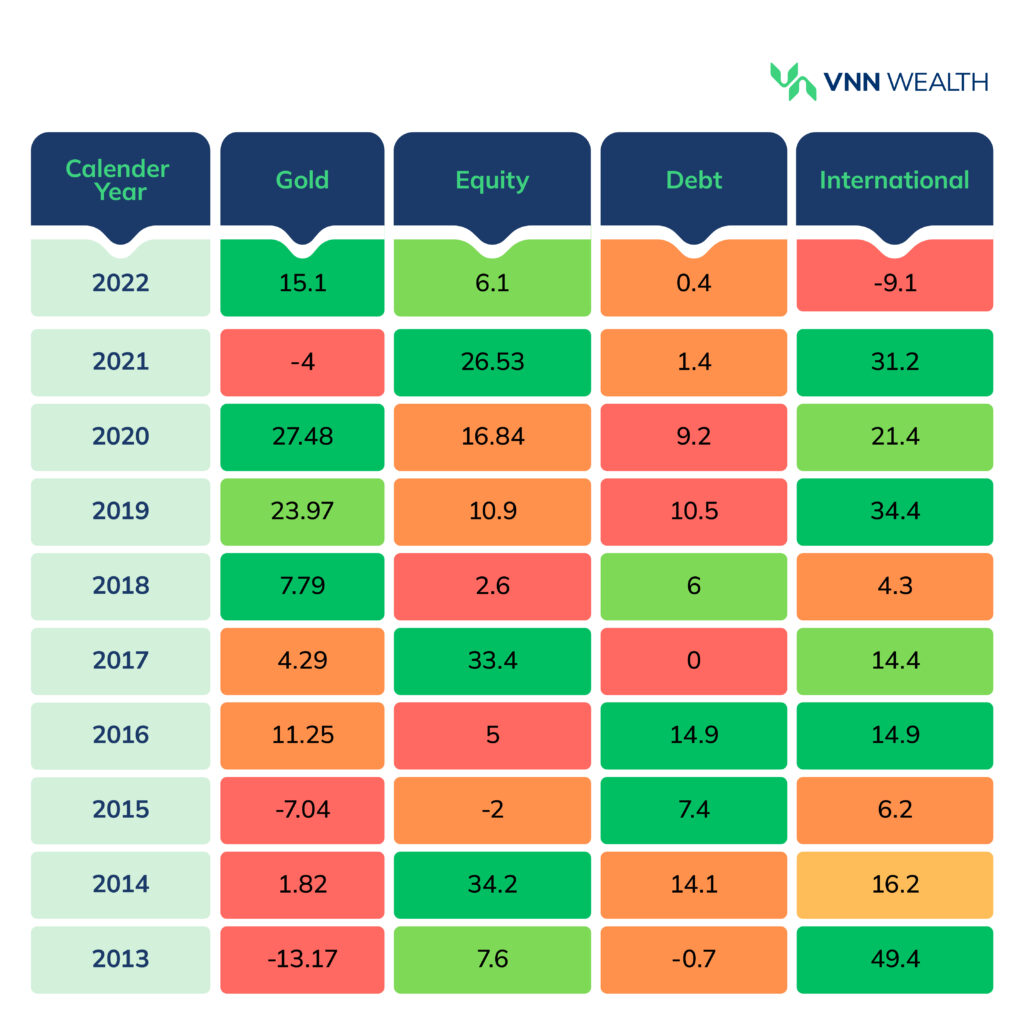

3. Don’t Invest All Your Money in One Asset Class

Diversification plays a crucial role in bringing superior returns with downside protection. To achieve true diversification, you must distribute your money among various asset classes such as stocks, bonds, gold/silver ETF, etc.

The right asset allocation encourages balance and diversification. When one asset class declines in performance, the other can keep your portfolio moving.

Therefore, avoid investing the majority of your money in a single asset class.

4. Don’t Panic Sell

Seeing your portfolio performance drop during a volatile market may cause emotional turmoil.

At times like this, panic selling is the last thing you want to do. In fact, correction in the market should be used to invest more.

The market bounces back as the economy recovers or as soon as the event passes (for example COVID-19). All you have to do is stay patient and let your wealth grow at a steady pace.

5. Don’t Try to Time The Market

Many investors focus more on timing the market than consistently investing. Let’s assume for the sake of example- Sensex drops by 1000 points from the current 73150 points (as of 15th Jan 2024), i.e. 1.36% drop.

If you plan to stay invested for a longer horizon, that 1.36% drop is not significant enough to time the market. Rather start an SIP and let your investment consistently grow at a steady pace.

Mutual fund investments are meant to achieve financial goals in a given time frame. Therefore, focus on spending more time invested in the market.

Final Thoughts

Mutual funds are powerful tools for building wealth. However, investing in them requires patience and awareness.

By following the above dos and don’ts, you can certainly navigate through the changing economic situations. Follow your financial goals and stay informed.

If you are looking for financial advisors in Pune, experts at VNN Wealth can meet you in person. Reach out to us via Email. If you’re not based in Pune, you can also book a consultation call at your preferred time. Get a complimentary portfolio review and plan your investments accordingly.

Read more personal finance insights.