Investing Basics

Multiply Knowledge. Multiply Wealth.

Blogs

I’m always surprised by how often people wrongly plan for their short-term financial goals. I recently met someone who invested in the Quant Small-Cap Fund. Great for the long-term, I encouraged, until they mentioned it was for buying a car within a year! I couldn’t help but sigh. Out of curiosity, I talked to a […]

Did you know- Over 60% of civil cases in India are related to land/property disputes? Reason – lack of estate planning. Estate planning is one of the crucial pillars of your financial plan. It sets your financial affairs in order, ensures tax efficiency, and offers financial security for your loved ones. Yet, people often ignore […]

Market timing risk is the biggest fear of every investor, especially while investing a large amount. No one can predict a market crash and the time it takes to recover. The anxiety of a potential loss is the reason many investors hesitate to invest a lump sum. That’s where a Systematic Transfer Plan comes into […]

Get an exemption on long-term capital gain tax through 54EC Capital Gain Bonds. Here’s everything you need to know! Selling immovable property such as land or a house brings generous profit; especially after a long duration. However, that profit soon attracts capital gain tax. Thankfully, there’s an easy way to avoid or lower capital gain […]

Uncover myths & facts about mutual funds. Mutual funds are surrounded by many misconceptions. Debunk these mutual fund myths and become financially independent.

Each Lok Sabha election has impacted the Indian stock market, causing both Nifty 50 and Sensex to rally before the election. The historical data shows the market movements during general elections.

Taxation and TDS rules for NRIs on equity mutual funds, debt mutual funds, and hybrid funds. Read more.

Portfolio management service is a financial offering in which an expert manages investor’s portfolio of equity, debt, bonds, and individual assets. Investors can customize their portfolio to align with their financial goals.

Explore the different types of returns on your mutual fund investments: CAGR, XIRR, Absolute Returns, Annualized Returns, Trailing Returns, Rolling Returns, Total Returns.

The technical aspects of the mutual fund factsheet can help you compare the two funds effectively. Here is how you can read the volatility measures aka key ratios of a mutual fund.

Unlisted Shares are privately held financial securities that trade Over The Counter instead of on the stock exchange.

The power of compounding interest can exponentially build wealth over the years by earning interest on the principal and the accrued interest.

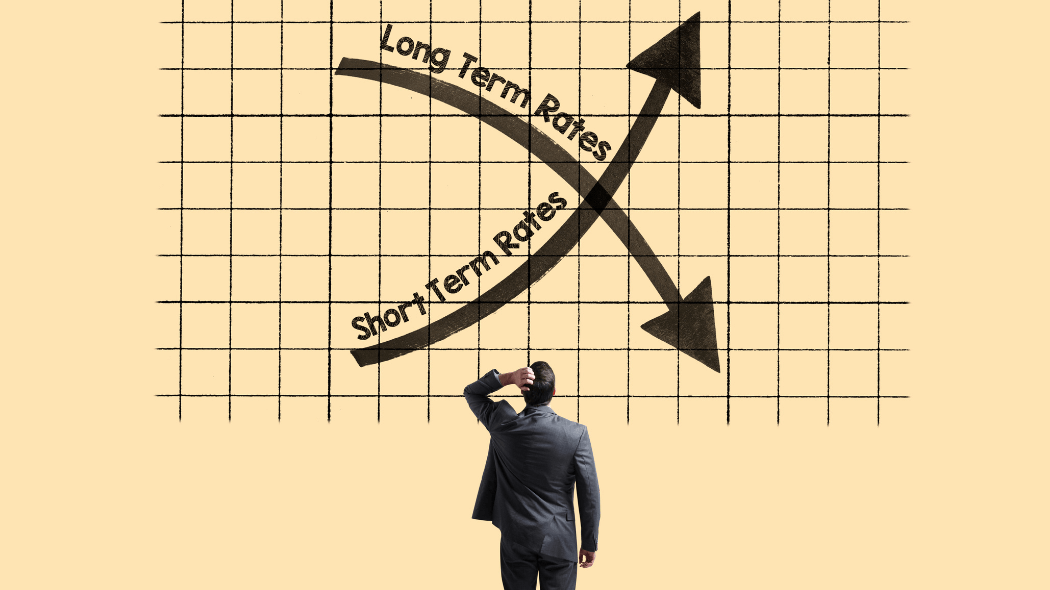

The inverted yield curve indicates that the short-term yield is more than the long-term yield. Find out what each curve represents.

Balanced Advantage Funds (BAF) follow a hybrid/dynamic asset allocation model between equity and debt with no threshold on asset allocation.

Large cap mutual funds invest at least 80% of total assets in the top 100 companies (large cap) in terms of market capitalization.