I’m always surprised by how often people wrongly plan for their short-term financial goals.

I recently met someone who invested in the Quant Small-Cap Fund. Great for the long-term, I encouraged, until they mentioned it was for buying a car within a year! I couldn’t help but sigh.

Out of curiosity, I talked to a bunch of other people regarding their short-term financial goals. Turned out, many of them are investing in high-risk instruments for their short-term goals.

If there’s one thing my financial journey has taught me- it’s that every goal needs a timeline. And every timeline has a suitable investment option.

So in this blog, I’m particularly focusing on smart investment planning for short term goals. We’ll talk about how to plan your short-term goals, what options to choose, and how to optimize your portfolio.

Let’s get started…

Any goal you aim to achieve within 3 years is a short term financial goal. It could range from a couple of months to a couple of years.

For example,

| Goal | Timeline |

| New phone | 1 month |

| Going on a vacation | 2 to 3 months |

| Buying a car | 3 to 6 months |

| Home renovation | 1 year |

| Child’s education fees | 1.5 to 2 years |

| Down Pay for a new home | 3 years |

To optimize it further, assign priorities to your goals. For instance, your child’s education fees are more important than home renovation. Or maybe buying a car can wait until you renovate your home. It’s up to you.

Since these goals have a shorter timeline, your investments need to be liquid and low-risk. Which brings us to the next, rather important, point…

As I talk to investors from different age groups every day, I have noticed a common misconception. They think equity mutual funds offer quick growth. This thought process comes from the bull run they noticed a couple of years ago. They’ve probably experienced some quick wins.

However, equity mutual funds can be highly volatile and risky for short term goals. The time horizon is simply too short for these funds to recover from potential losses.

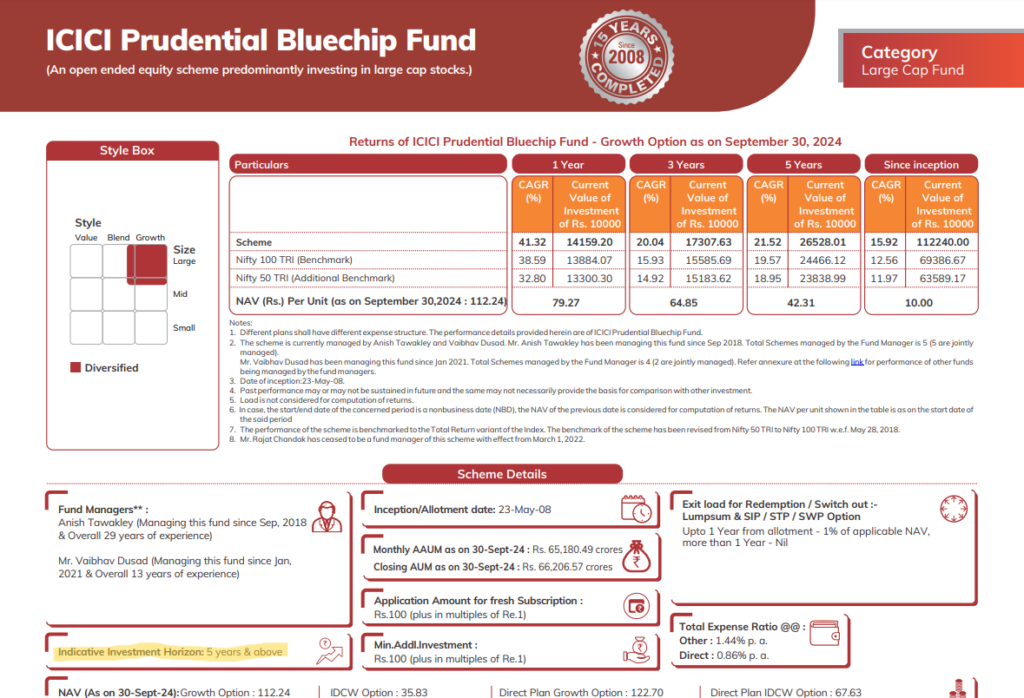

Most people are unaware that every mutual fund category has an ideal time horizon. It’s always mentioned in the fund’s factsheet.

Here’s an example of the ICICI Prudential Bluechip Fund. As you can see in the highlighted segment, the indicative investment horizon is 5 years and above.

If you can’t find the ideal time horizon on a factsheet, here’s a general rule:

| Goal Timeline | Mutual Fund Category |

| 0 to 3 years | Debt Mutual Funds / Hybrid Funds |

| 3 to 5 years | Large Cap Mutual Funds |

| 5 to 7 years | Mid Cap Mutual Funds |

| 7+ Years | Small Cap Funds |

For short-term goals, you should ideally explore debt funds or hybrid funds; NOT pure equity funds.

Debt funds specifically have categories based on duration profiles ranging between 1 day to 7+ years. Common underlying assets in debt funds are Treasury Bills, government bonds, corporate bonds, certificates of deposit, etc. These assets are not as volatile as stocks in equity funds. They offer predictable annual returns and are less risky. Most importantly, these funds have the potential to deliver superior returns compared to savings accounts or FDs.

Hybrid funds are a combination of equity, debt, gold, and international equity. These funds are slightly riskier than debt funds but less riskier than pure equity funds. Hybrid funds can cater to your short-term goal with a 3-year timeline.

Every investment product carries a certain amount of risk. You have to choose the ones that ensure capital protection. Pure equity funds can be extremely risky over a short horizon. You might end up losing money. Debt funds, on the other hand, carry low risk on capital.

Liquidity is extremely important as you’ll be withdrawing money in a short timeline. While mutual funds don’t have a lock-in period, they certainly have an ideal investment horizon. As shown above, pure equity funds usually demand 5+ years to recover from potential losses. Plus, it is ideal to stay invested for a longer horizon to benefit from compounding.

Debt funds are clear winners when it comes to liquidity. The ideal investment horizon is usually much smaller for debt funds based on the category.

You cannot predict the outcome of equity mutual funds, especially in the short term. You might look at the past performance and think, this seems promising. However, past performance does not guarantee future returns. It all depends on the market conditions. The chances of the market performing in your favor in the short horizon are very slim.

On the flip side, debt funds at least deliver predictable returns. It depends on the interest rate cycle. So, the interest rate might affect returns on debt funds, but it also holds true for FDs, savings accounts, etc. In fact, debt funds often outperform FDs, and Savings accounts for a similar horizon.

Having said that, let’s explore some mutual funds for your short-term goals.

Liquid funds invest in securities maturing between 7 to 91 days, which means, you can withdraw your money anytime you need.

Here are some of the examples of liquid funds:

1. Bandhan Liquid Fund

2. Franklin India Liquid Fund

3. Quant Liquid Fund

Tip: Liquid funds are also suitable for investing a lumpsum amount for a few months and starting an STP (Systematic Transfer Plan) afterward into an equity fund of your choice. Read more about STP here.

Ultra short-duration funds invest in instruments that mature within 3 to 6 months. These are moderate to low-risk funds that often deliver better returns than liquid funds.

Below are some examples of ultra-short duration funds you can explore:

1. Aditya BSL Savings Fund

2. Bandhan Ultra Short Term Fund

3. Mirae Asset Ultra Short Duration Fund

Low duration funds hold underlying instruments with 6 to 12 months of maturity period. With relatively lower risk, these funds deliver decent returns over a year.

Examples of the low duration funds:

1. ICICI Prudential Savings Fund

2. Axis Treasury Advantage Fund

3. UTI Low Duration Fund

Money market funds are ideal for your financial goals with 1 to 1.5 years of horizon. These funds invest in securities maturing within a year.

Some examples of money market funds:

1. Nippon India Money Market Fund

2. Axis Money Market Fund

3. TATA Money Market Fund

As mentioned above, hybrid funds are ideal for short-term goals with a 3-year horizon. This category includes Balanced Advantage Funds, Multi-Asset Funds, Dynamic Asset Allocation Funds, Equity Savings Funds, etc. The funds invest in stocks, bonds, gold, and international equity, depending on the fund’s subcategory and objectives.

Unlike pure equity, these funds are moderately risky and cater to your short to medium term goals. And the allocation in various asset classes offers instant diversification.

Whenever I mention debt funds to investors, I get two kinds of responses. One- they’re not aware of these funds. Two- they’re aware of the debt funds taxation and aren’t convinced.

Yes, taxation is absolutely an important factor in your financial goals. You should calculate post-tax returns for all your investments.

But, since we’re talking about debt funds for your short term goals, let’s clear all your doubts.

As per the taxation rule set in April 2023, both short and long term gains on debt funds are taxed as per the investor’s tax slab. Ever since this new rule, investors began turning their backs on debt funds.

I get it. Previous taxation rules were much better but that’s not the case anymore. So then why do debt funds still make sense?

For these reasons:

1. Interest earned on your savings account, FDs are also taxed as per your tax slab.

2. Debt funds have the potential to deliver 1 to 2% extra returns, which means, you earn better post-tax returns.

3. Plus, if you keep your money idle in your savings account, you might end up spending it on something unplanned. On the other hand, redemption from debt funds takes up to 24 hours to land in your account. So debt fund withdrawals are not as swift as the savings account, protecting your capital from your spending habits.

4. And, you can invest for the timeline suitable for you.

Read more about FD vs Debt Funds.

Here’s how you should plan your short-term goals:

Note down all the financial goals you want to achieve in a year or two. Assign priorities and timelines to each of them. This gives you a clear picture to invest accordingly.

Many investors skip this step, but knowing your risk appetite is important. Take the risk profiling quiz to understand your risk tolerance. This step helps you plan your short, medium, and long term goals.

Invest as per the timeline of your goals. Equity funds can cater to your long term goals. Debt and hybrid funds are suitable for your short-term goals.

4. Review your overall portfolio

Your current investments also need to be evaluated against your new investments. That way, you can optimize your entire portfolio and generate superior post-tax returns. Regular portfolio review also helps you realign your investments as per your ever-changing financial situation, goals, and risk appetite.

Short-term financial goals are often mismanaged. People either invest in the wrong instruments or don’t bother investing at all. However, short-term goals are equally important. With the right mutual fund categories, you can streamline your finances.

Don’t make the mistake of investing in high-risk avenues for the short term. Instead of chasing quick wins, focus on liquidity, capital protection, and risk-adjusted returns. Assign priorities to your goals, assess the timeline, and invest wisely.

If you need help planning your financial goals, get in touch with VNN Wealth, a widely trusted wealth management firm in Pune. Our experts will review your portfolio, and assist you in choosing the funds and investing. Explore our products for more information.