Impact of Elections on the Indian Stock Market

The Lok Sabha elections are right around the corner and the stock markets are already experiencing the impact.

If the historical data is any indication, the bull run of the stock market leading up to the general election is inevitable.

Many events influence stock market movements. And the Lok Sabha elections are probably the biggest event to move the market before and after the results.

In this article, we will shed light on how elections can spark jumps in the stock market.

History of Market Movements Before and After Elections (Between 1999 to 2019)

The election period is often the time when the market sentiments change. It’s an uncertain period of change causing volatility in the stock market.

Indian economy and the policies may shift during these times.

The average returns a year prior and a month prior to the elections are 29.1% and 6% respectively. This indicates the market returns boost a year before the elections.

Below is a snapshot of how the market performed before and after the elections.

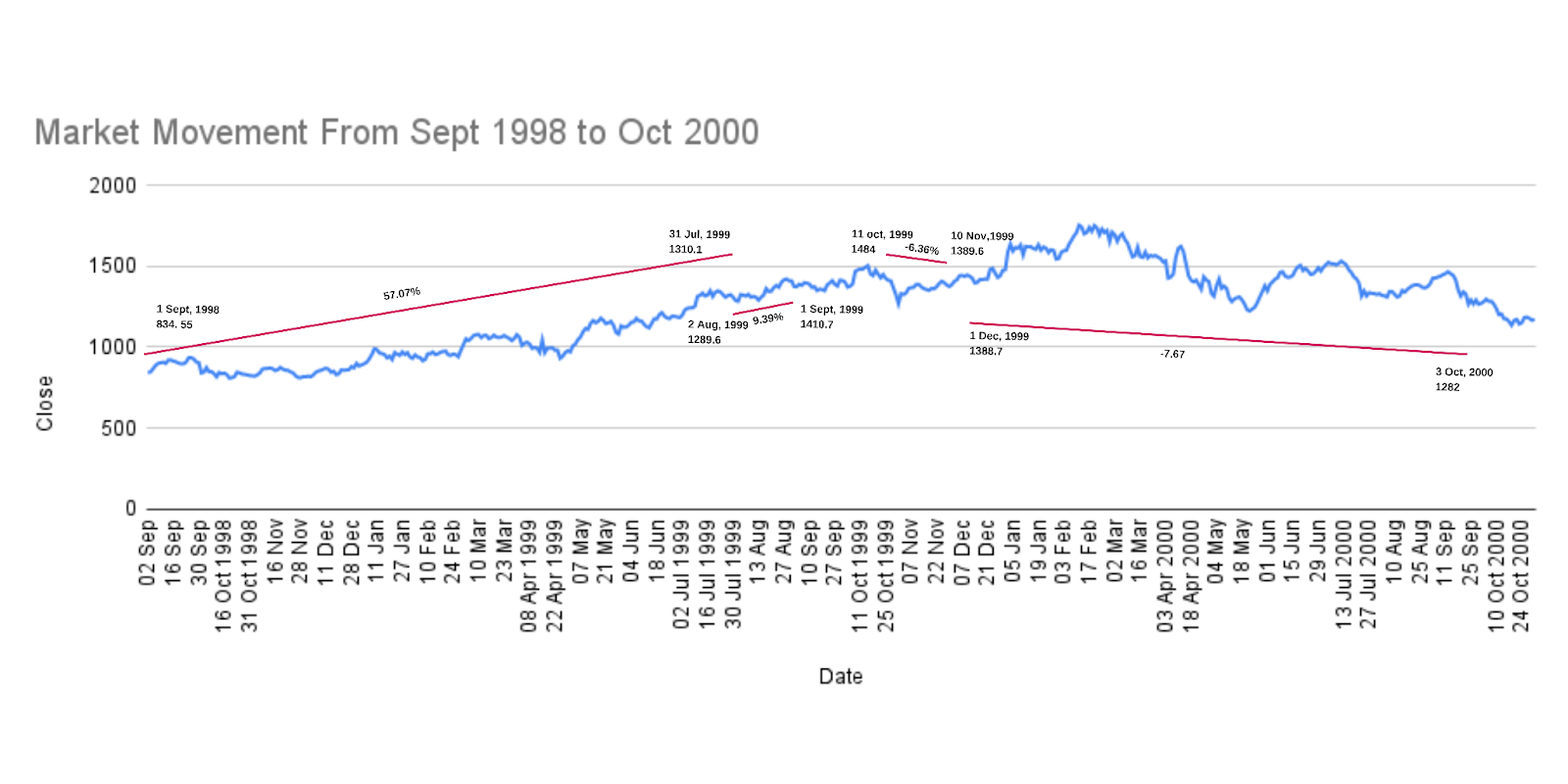

Lok Sabha Elections 1999 (Took place between Sept 1999 to Oct 1999)

- The controversy around PM Rajiv Gandhi and his assassination in 1991 took the market by storm. The market instability amplified. However, PV Narasimha Rao regained economic conditions with liberalization policies thereby restoring stability.

- From 1996 to 1998, the market confidence struggled due to the unstable Coalition Government and the Asian Financial Crisis. Indian prime ministers changed three times during this course of time.

- NDA came to power in 1999, prior to which, the market delivered 57.07% returns between Sept’98 to July’99. However, the market corrected by 7.67% a year after the victory. The structural changes and sectoral reforms caused GDP growth of 6-7%.

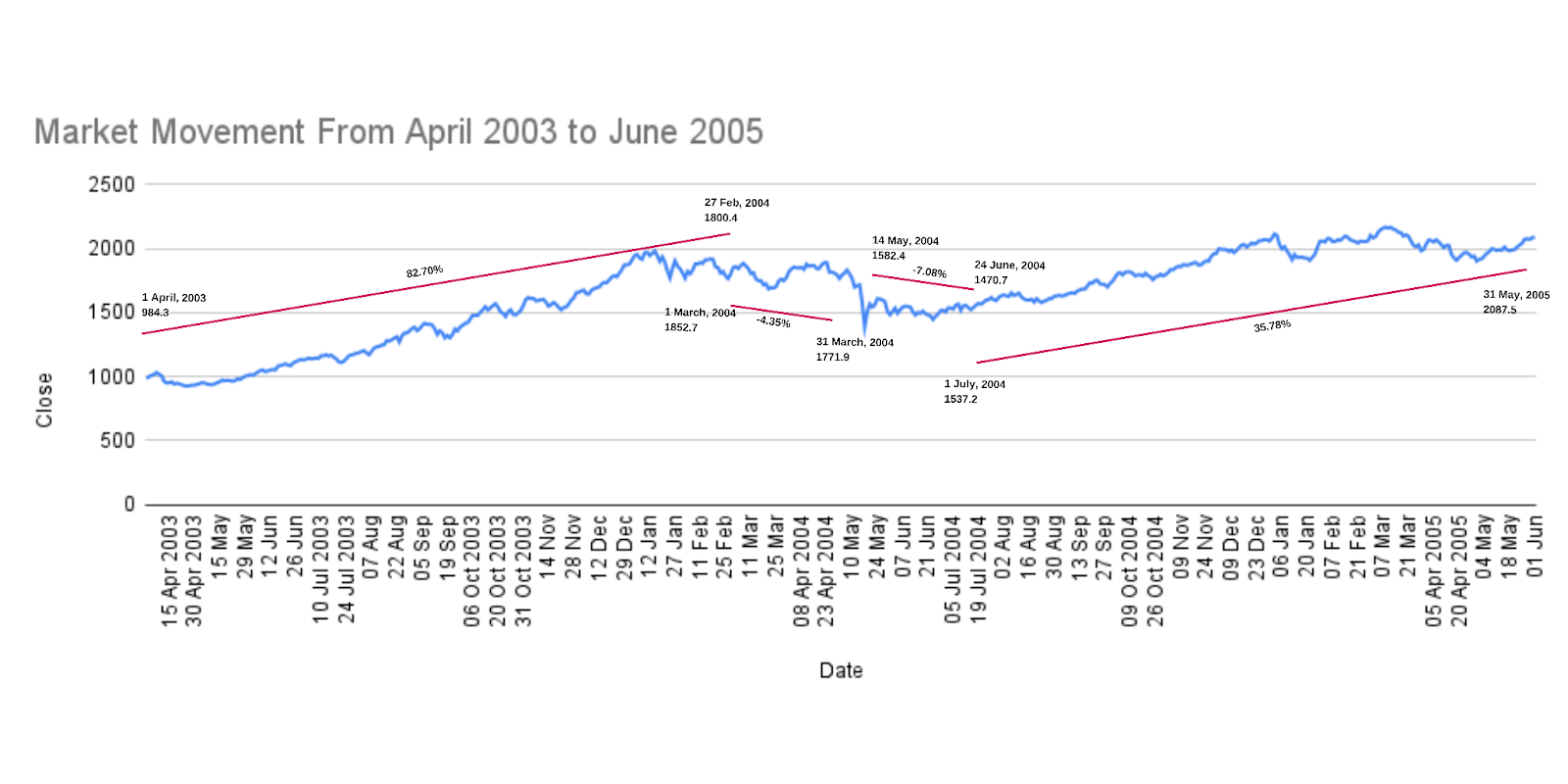

Lok Sabha Elections 2004 (Took place between April 2004 to May 2004)

- A year prior to the 2004 election, the market delivered 82.70% returns between April 2003 to Feb 2004. The market declined by 7% following the elections but soon rallied up until 2007.

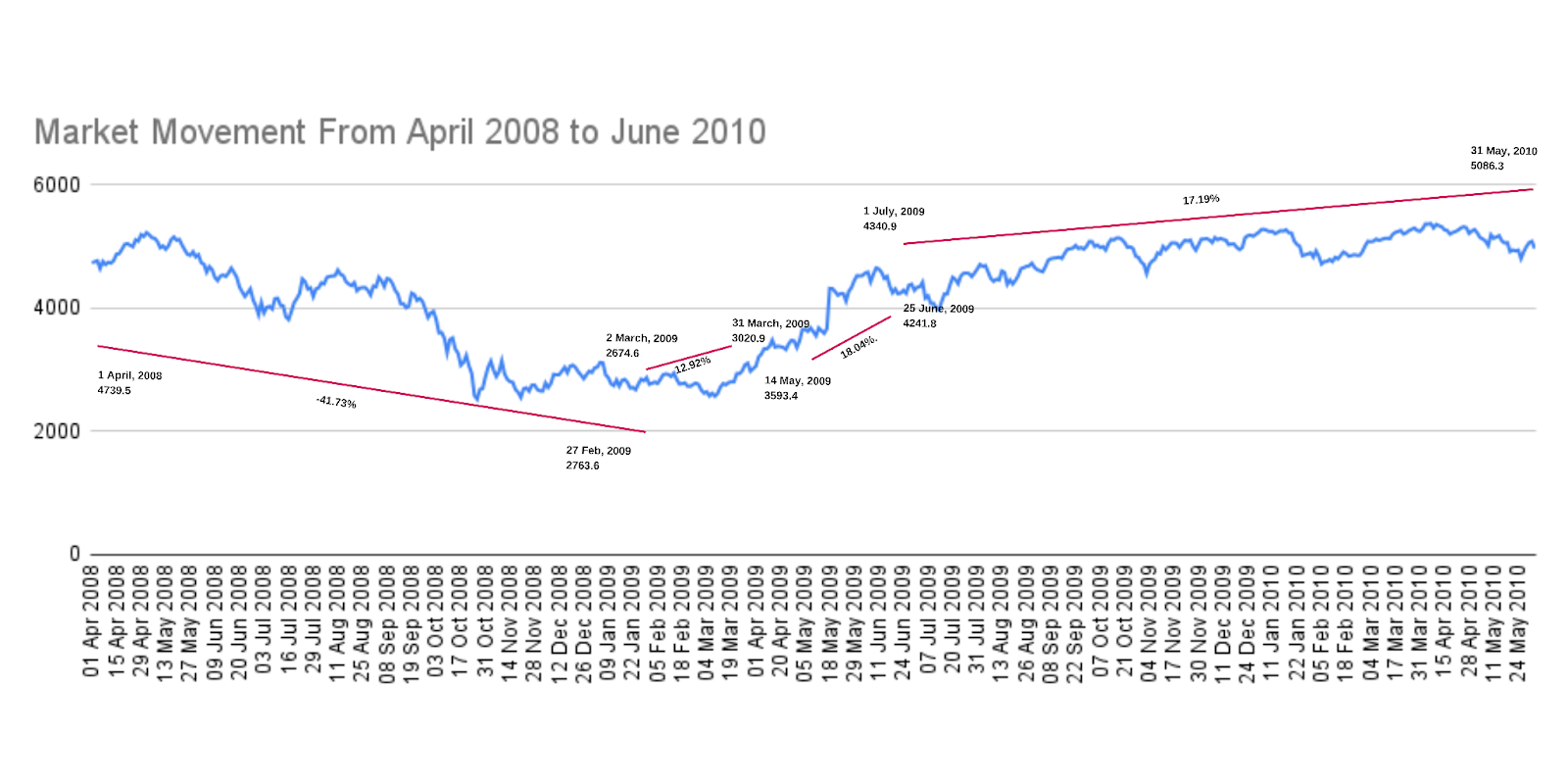

Lok Sabha Elections 2009 (Took place between April 2009 to May 2009)

- The market dropped by 41.73% a year before the 2009 election. This was the year when a financial meltdown dramatically changed the worldwide economy. The market delivered 12.92% returns a month before the election. UPA’s second term saw policy uncertainties, scams, a high inflation rate and a struggle to stabilize the economy, which resulted in an economic slowdown.

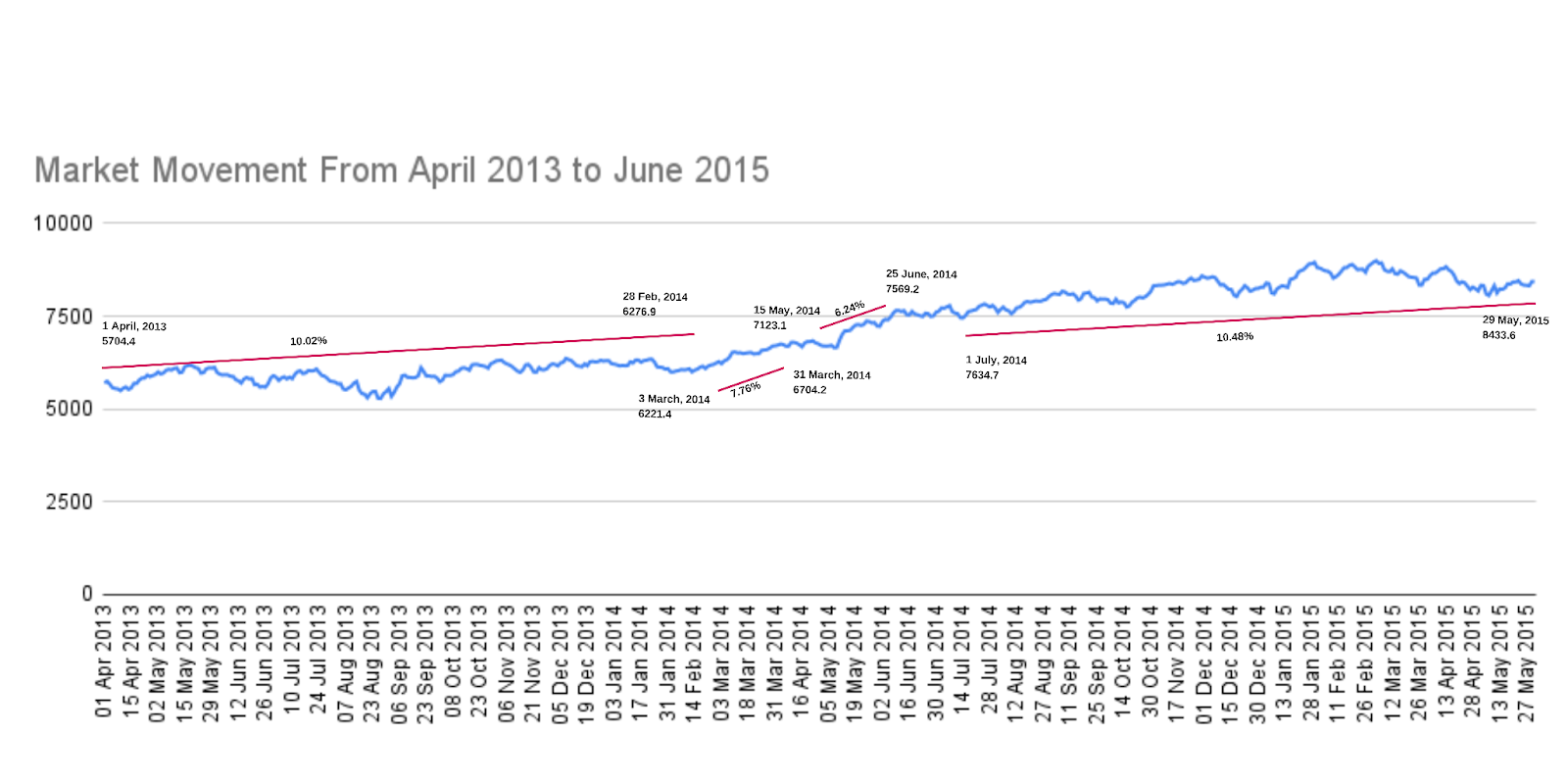

Lok Sabha Elections 2014 (Took place between April 2014 to May 2014)

- NDA, led by the BJP, returned with a victory in the 2014 election, reducing market volatility to 9.1%. The market delivered 10.02% gains a year before the win and 10.48% a year after the win, with 37% 2-year returns.

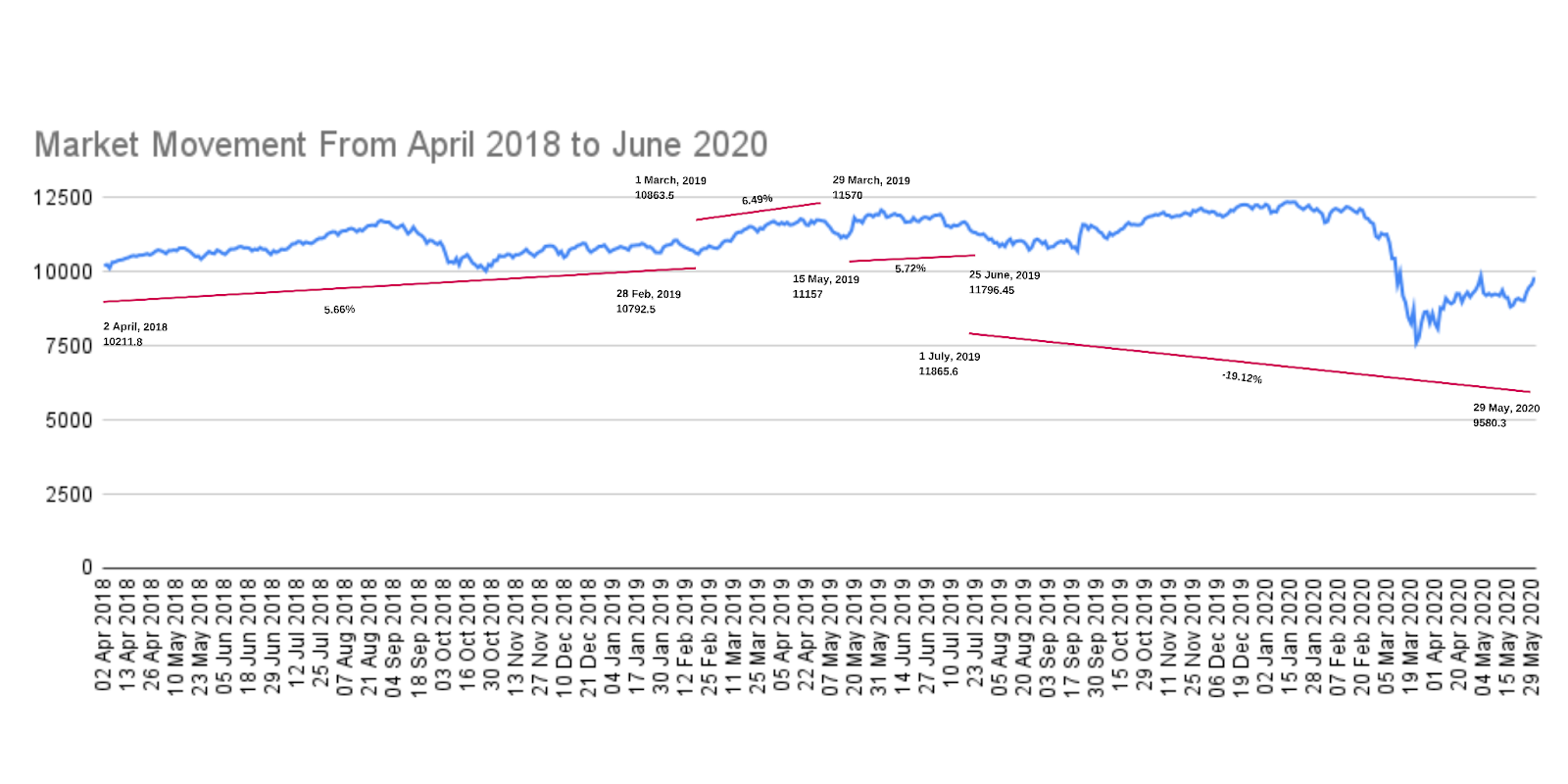

Lok Sabha Elections 2019 (Took place between April 2019 to May 2019)

- BJP continued governing the nation after the 2019 election, aiming for economic stability. However, COVID-19 made all the nations suffer, causing the markets to drop significantly. The market corrected by 19.12% a year after the election, which was the COVID period. The bull phase was seen when the impact of COVID-19 was fading in 2021-22.

As BJP won the assembly polls in Rajasthan, Madhya Pradesh, and Chattisgarh, both Nifty and Sensex climbed up the new lifetime highs. The election wave will see the market rally until the elections in April-May 2024. Only the time ahead will tell where the market eventually stands before and after the election.

Stay informed about the latest

news and updates.