A volatile market is like a roller coaster. Your portfolio rides through the dynamic financial markets, experiencing thrilling peaks, sudden twists, and unexpected turns. Those rapid highs and nerve-racking lows can be unsettling. The anxiety and uncertainty about the future can lead to portfolio destructive actions.

But…

Market movements are inevitable. Even the most seasoned investors cannot accurately time the market every single time. The only solution to achieve financial security in a volatile market is to have a solid investment strategy. In this blog, we will provide actionable steps to achieve financial security in the ever-changing landscape of financial markets.

Market volatility is the degree to which the prices of financial assets change over a period of time. Numerous factors affect market movements such as:

1. Shift in the supply and demand.

2. Economic conditions, GDP growth rate, inflation rate.

3. Political instabilities, elections.

4. Geopolitical events like wars, and international conflicts.

5. Changes in government policies.

6. Natural disasters and pandemics.

Let’s take an example of COVID-19. Nifty fifty dropped by ~18.65% between Feb 28 to April 9, 2020. However, Nifty 50 experienced a boost of 124% from April 2020 to Oct 2021.

As you can see in the Nifty 50 chart below, the market rallied up soon after every crisis.

Elections are another example of sudden market movements. The stock market goes through a bull run leading up to the market and corrects during/after the elections. The average returns a year before and a month before the elections are 29.1% and 6% respectively. You can observe the impact of elections on the stock market here.

Events like these can trigger panic-selling or impulse-buying, destroying your investment strategy. It is important to stick to your strategy despite the market volatility. That way, you can still achieve your financial goals in time without worrying about short-term pitfalls.

Now let’s dive into a step-by-step guide to maintain a strong investment strategy to achieve financial security.

The first and very crucial step before putting together an investment plan is to evaluate your financial health. Here’s a simple check-list:

Regularly monitor your assets such as savings across all bank accounts, your investments in stocks, mutual funds, FDs, real estate, etc. Keep track of your expenses and liabilities like mortgages and loans.

Derive your annual income based on your salary and income received from your investments in the form of interest, dividends, rental income, capital gains, etc. Keep all your financial statements in handy for accuracy.

You can use simple tools like Excel to analyze your monthly expenses. Nowadays, bank applications also provide a spend analyzer feature. You can download the report to understand your expenses in various categories.

Putting together your finances will help you construct a plan. You can consider hiring a financial advisor to navigate the complexities of finances. Experts at VNN Wealth are always just a call away.

A diverse portfolio is the key to lowering the risk of market volatility. It involves spreading your investments across various asset classes to balance your portfolio. Once you know how much money you want to invest, you can explore instruments that align with your risk profile. Take a risk profiling quiz to know the percentage of equity and debt you must hold in your portfolio.

Asset Class Diversification: Invest across different asset classes such as stocks, bonds, real estate, gold, etc. To begin with, you can invest in multi-asset funds that offer instant diversification. For example, ICICI prudential multi-asset fund.

Geographic Diversification: Introduce geographic diversification by investing in international investments. You can explore mutual funds with exposure to international stocks. For example, Motilal Oswal Nasdaq 100 Fund of Fund, SBI International Access - US Equity Fund of Fund. Or buy direct stocks of international companies such as Amazon, NVIDIA, Facebook, Google, Apple, and Netflix.

Sectoral Diversification: Diversify your investments across various sectors such as the solar energy sector, technology, healthcare, pharma, Auto, Cement, Telecom, Financials, etc. You can consider investing in sector-specific mutual funds such as Nippon India Banking and Financial Services Fund, and Franklin India Technology Fund.

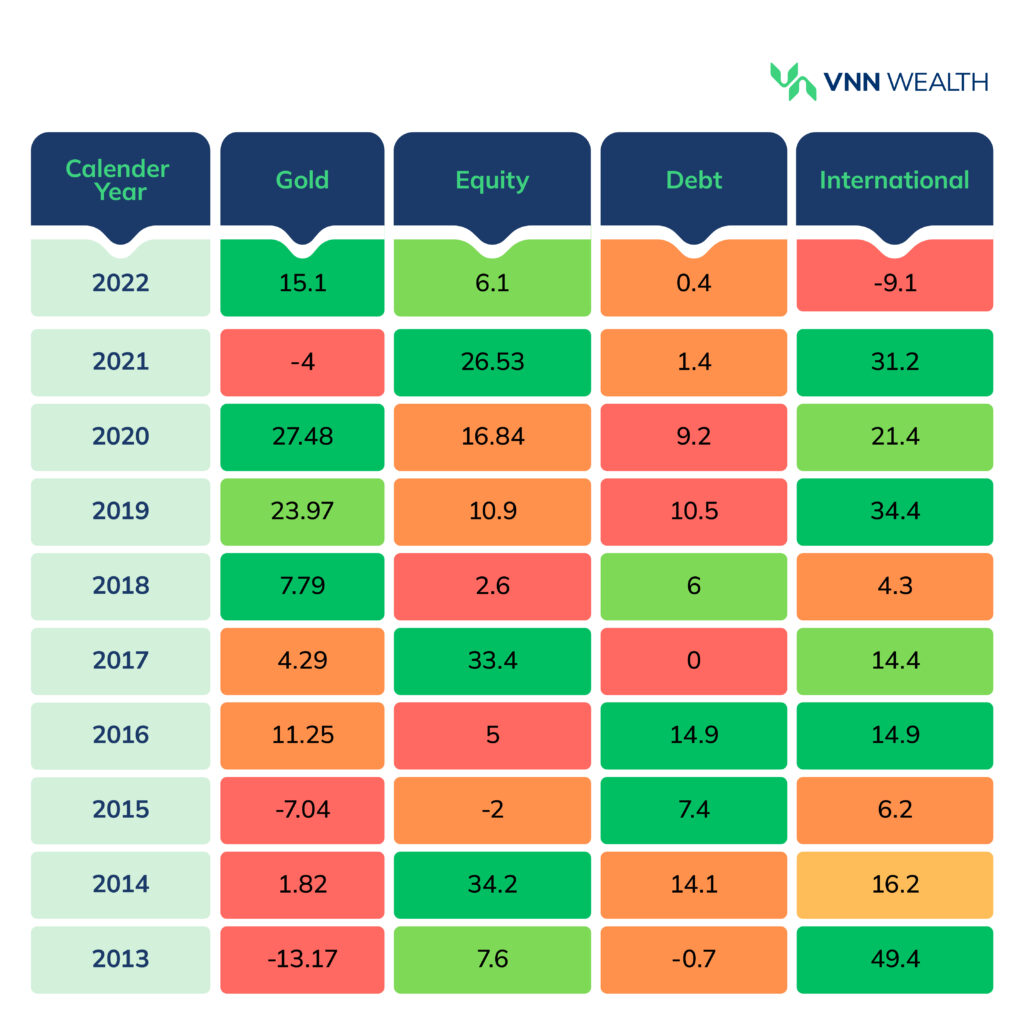

Take a moment to examine the table below.

[Data Source: Bloomberg]

As you can see, every asset class goes through its own ups and downs in changing economic conditions. For example in 2022, gold performed better than equity but the scenario was reversed in 2021. A proper asset allocation is crucial to avoid dependency on a single asset class. That way, the poor performance of one asset class can be overcome by other well-performing asset classes.

While your investments grow over the years, an emergency fund is your safety net. It offers financial security amid volatile market. Instead of panic-selling your investments during market volatility, give them time to grow. You can rely on your emergency fund for the time being.

Aim to save a year's worth of emergency savings in an easily accessible account. Calculate your monthly expenses and multiply the amount by 12. That amount covers your living expenses for a year. Keep it on standby to utilize for an absolute emergency.

Having a specific goal helps you stay on track. Define a specific amount each month to put aside. Alternatively, you can dedicate a lump sum amount that you won’t be utilizing anytime soon. Ensure you have 6-12 months of expenses sorted at all times.

Many investors prefer keeping an emergency fund in a savings account. While there’s nothing wrong with it, it’s not sustainable. You might end up using those funds due to easy access.

Instead, park your money in liquid funds like Aditya BSL Liquid Fund, Bandhan Liquid Fund or short-duration debt funds such as Mirae Asset Ultra Short Duration Fund, and ICICI Prudential Ultra Short Term. Debt funds generally offer better interest rates than savings accounts. Plus, you won’t withdraw these funds as easily as you would from your savings account.

Below is a snapshot of different categories of debt funds with current yield and tenure.

Make sure you keep tracking your emergency fund. Whether you choose to automate your contributions or manually transfer funds, periodically monitor your progress.

Economic conditions and financial markets always change. Therefore, you must periodically review your portfolio to align it with the changing market conditions.

Tracking Investment Performance: Regularly track your portfolio’s performance to ensure your investments align with your financial goals. Identify poor-performing investments and replace them with high-yield instruments.

Evaluate Your Risk Profile: Your risk tolerance may change over time. As your expenses and financial situation evolve, you must re-evaluate your risk profile.

Financial Goals and Timeline: Your financial goals such as retirement, children’s education, buying a house, etc. may change with time. Therefore, reviewing your financial goals and adjusting the timeline of your investment is a necessity.

Having a professional financial advisor by your side can significantly fast-track your financial goals. An expert can help you build a benchmark-beating portfolio while navigating through the volatile markets.

Personalized Investment Strategies: You can get your portfolio reviewed by an expert. A financial advisor can outline an investment plan catering to your financial goals and risk tolerance. This includes identifying poor-performing investments, readjusting your current investments, and optimizing your portfolio for better post-tax returns.

Risk Management: Risk on your investments is never zero. However, an expert can help you mitigate that risk through portfolio diversification. Investing across various asset classes is crucial to ensure financial security during volatile market.

Tax Optimization: You cannot avoid taxes but you can certainly reduce your tax liability. A dedicated financial advisor will suggest suitable tax-saving instruments to minimize tax liability and maximize post-tax returns.

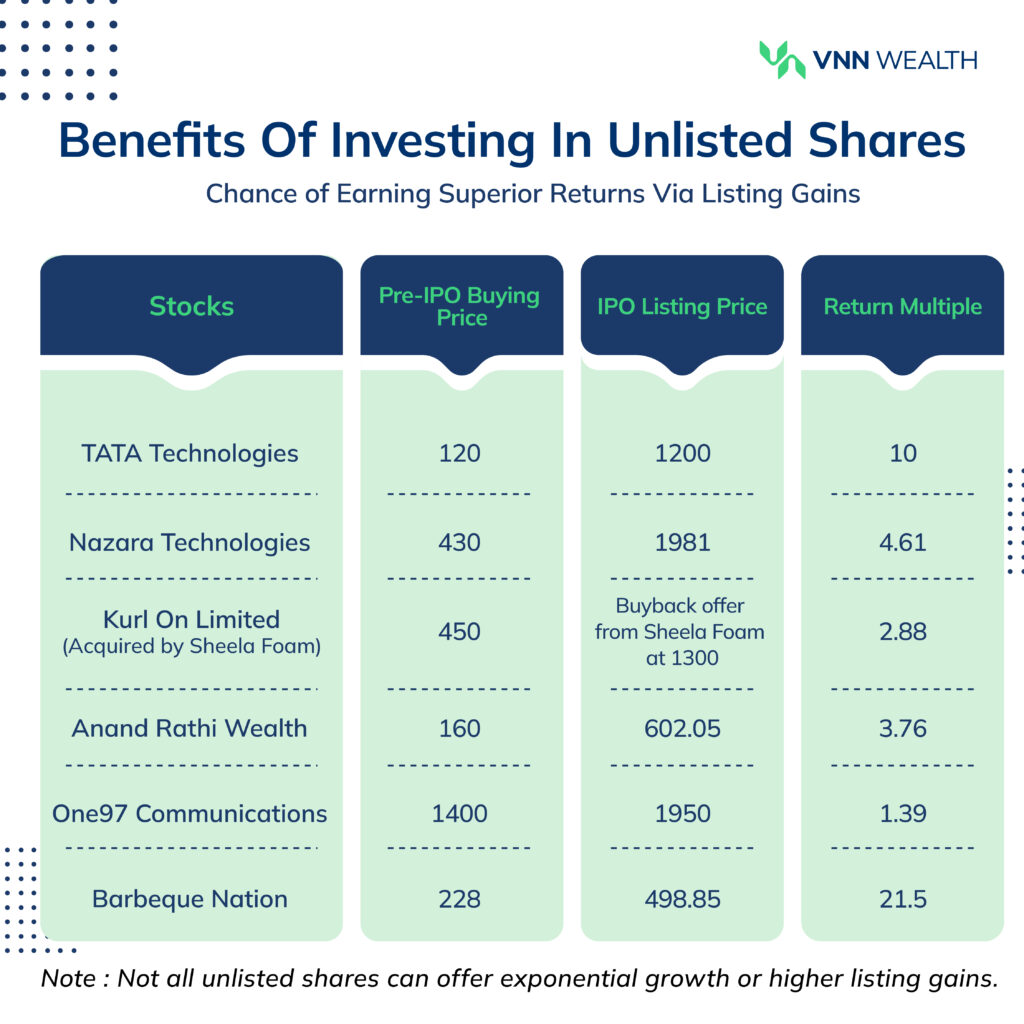

Exclusive Investment Opportunities: A financial advisor can bring exclusive investment opportunities to the table. For example, unlisted shares. A lot of investors are unaware of such opportunities. Below are some of the unlisted stock opportunities we opened up for our clients, delivering excellent returns.

Long-Term Financial Planning: A long-term financial plan lowers the short-term risk of a volatile market and amplifies your wealth. A financial advisor can help you plan and achieve long-term financial goals such as retirement planning, estate planning, legacy building, etc.

Tip: Choose a financial advisor with relevant experience, proper licenses, and a good reputation.

Growth demands time. You cannot expect your money to grow overnight. To achieve your financial goals, you have to think long-term. Don’t focus on the short-term loss, focus on the long-term growth. Note that every market crash is followed by a market rally. What you invest today is bound to grow in five years.

Setting clear goals and sticking to them: Setting goals is not enough. You have to stick to them to let the strategy play out in your favor. Prefer goal-based investing so that you don’t have to think about short-term decline in your portfolio.

Keep your emotions in check: Fear and greed can lead to either panic-selling during a market crash or impulse buying during a market rally. Both of which can crumble down your overall portfolio. Don’t check your portfolio movements every day. It’ll only make you anxious. Follow your investment strategy with discipline and you’ll achieve your goals in a defined time.

Don’t try to time the market: It is impossible to time the market as it won’t always work in your favor. You could end up getting it wrong more times than right. Instead, seek guidance from your financial advisor on navigating market volatility.

Achieving financial security in a volatile market is possible with a robust investment strategy and disciplined approach. Assess your financial situation and set achievable goals. Ensure your investment portfolio is truly diverse by investing across various asset classes and sectors. The right mix of assets avoids dependency on a single class.

As you execute your investment strategy, don’t forget to establish a safety net. Set aside a year’s worth of expenses as your emergency funds in an easily accessible account or in liquid funds. The emergency fund will prevent the need for panic-selling during emergencies, allowing your investments to grow.

Prioritize long-term growth rather than short-term volatility. Stick to your strategy and periodically review your portfolio to re-align it with your financial goals. That way, you can surpass short-term volatility and come out on the other side with a solid portfolio.

Every investor’s risk appetite and financial preferences are different. Therefore a single strategy to achieve financial security in the volatile market cannot fit all. VNN Wealth can provide you with a comprehensive portfolio analysis and a personalized investment strategy catering to your financial goals. Visit our website to explore financial products. You can also browse our blogs for insights into the world of finance.