Early retirement is a dream for many.

In fact, one of the questions I’m often asked is, “How can I retire early and still enjoy a comfortable lifestyle?”

Everyone aspires to get out of their 9-to-5 grind and enjoy a peaceful life anywhere they please.

Achieving financial independence early in your life is absolutely possible. But most people I talk to seem to underestimate the importance of starting early, building the right investment strategy, and accounting for factors like inflation and healthcare.

Early retirement is achievable and sustainable with the right investment strategy and disciplined approach.

So in this blog, I will walk you through the proven strategies and necessary steps to achieve financial independence.

People have different goals for early retirement. Some want to retire in their 30s, others in their 40s or early 50s.

What’s your timeline? Having a clear goal in mind will help you align your investment strategies.

Secondly, define the kind of lifestyle you’d want to live after retirement. Do you want to travel a lot? Or settle in a comfortable home away from the city. What hobbies would you like to explore and can you fund those hobbies without worrying?

These are some important questions you need to ask yourself to understand what early retirement means to you.

Now, let’s unfold the retirement strategy step by step…

Having a figure in mind helps build an investment approach that you can follow. Let’s figure out what amount you need to retire and live a comfortable life.

The factors you’d need to consider are:

1. Your monthly income

2. Your EMIs

3. Current corpus including your savings and investments

4. Your current age and the age at which you’d like to retire

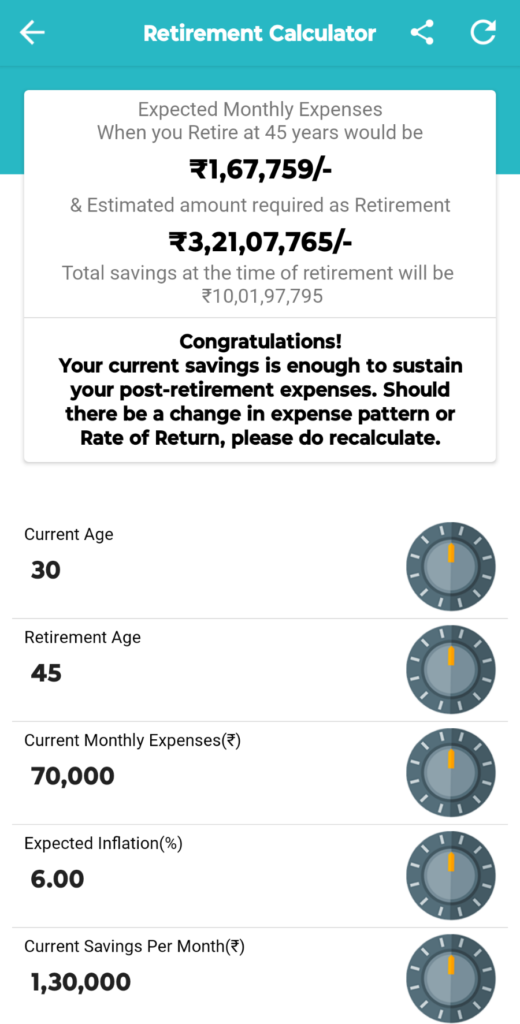

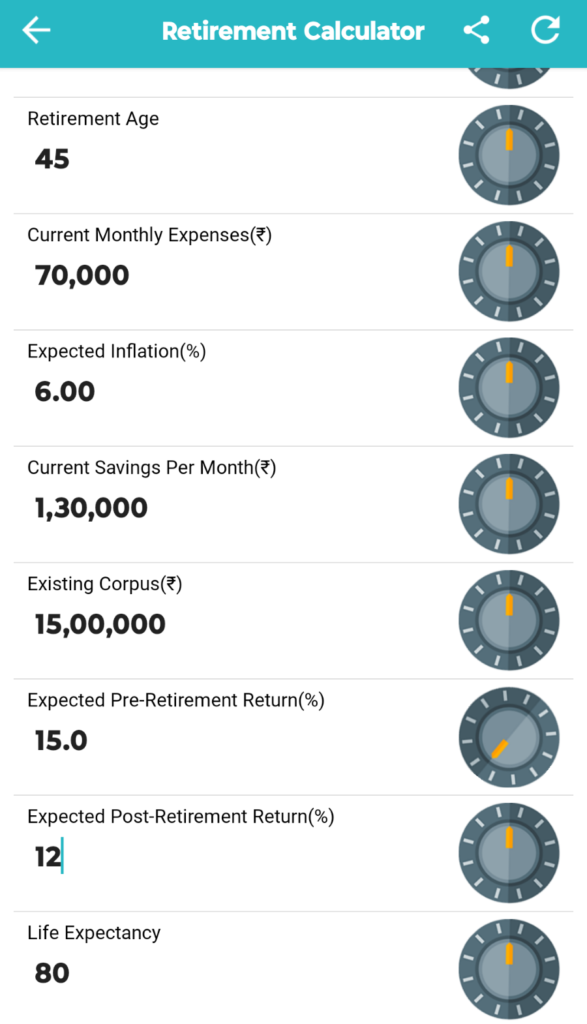

Now let’s take an example here:

Additionally, you have to factor in the inflation rate, the rate of returns on your current investments, and the returns you generate post-retirement.

For the sake of calculations, let’s consider the inflation rate as 6%, the current rate of returns on your investment as 15% and the post-retirement returns to be 12%.

Based on the calculations, your expected monthly expense after retirement would be INR. 1,67,759. You’d need at least 3 crores of corpus to retire comfortably and continue the same lifestyle. And if you continue to save the same amount, you’ll be able to generate a corpus of 10cr.

Sounds promising? But it’s easier said than done.

The above example is just to show you how you can calculate your retirement corpus. However, life is unpredictable. Your income and expenses might change. Your lifestyle might change. And many external factors might influence your financial journey.

Though the numbers might change for every individual, our calculator helps you get a sense of your retirement corpus. Download the VNN Wealth app from the Playstore to explore our calculators.

Having said that, if you truly want to retire early, there are certain things you need to follow with discipline. That brings us to the most commonly followed strategy to retire early.

The FIRE strategy is a philosophy centered around finance and lifestyle to help you achieve financial independence as early as possible. By following a FIRE strategy, you can retire earlier than the traditional retirement age.

The FIRE strategy encourages strategic investment, thorough financial planning, and certain lifestyle changes to achieve early retirement.

It follows a 4% rule, aka FIRE number to determine your annual expenses after retirement. The rule suggests that withdrawing 4% of your retirement portfolio every year is sustainable over 30 years.

For example, if your annual expense after retirement would be INR.10,00,000, then your fire number should be INR. 25 crores (1000000/0.04).

However, this 4% rule was created a long time ago when the economy was entirely different. It’s a historical number determined mostly by studying US trends, inflation rate, and annual rate of return.

With reference to India, the current annuity rate (average 5%) is a good reference point. That can help you generate your FIRE number.

The FIRE Strategy stands on three important pillars.

To make the FIRE work, you have to save at least 50% to 70% of your income. This may sound a bit of a stretch. Most people only end up saving 15-20% of their monthly income. Realistically speaking, after all your EMIs, children’s fees, groceries, and even 30% might seem impossible.

You can try maximizing your savings by boosting your income without upgrading your lifestyle. FIRE followers often switch to a high-paying job. Or they start a side business to earn passive income.

People who follow the FIRE strategy live a minimalistic life. I’m not asking you to stop spending. Some expenses are important.

However, you can identify areas where you can reduce or stop spending. For example, cancelling subscription of services you no longer use. Cooking at home instead of eating out. Not upgrading your gadgets unless they are not usable anymore. Renting a house vs buying. Tracking your monthly expenses, etc.

These small changes can help you save up to 30% more.

I have a client who retired early with a 30 crore corpus at the age of 50. He was in the merchant navy and was mindfully saving and investing throughout. His first SIP amount was monthly 1000 rupees. Over the years, as his income grew, he’d always increase his SIP amount instead of upgrading his lifestyle. Even after generating a large corpus, he spends wisely. Today if you ask him, he’ll only tell you to invest consistently instead of chasing returns.

All that money you are saving can make you more money if you invest it wisely. How and where you invest can be a game changer.

Ideally, you should start investing early to benefit from compounding. The more years you spend investing, the larger the wealth you’ll generate.

Here are a certain thing you can do to maximize your returns:

Knowing your risk appetite is crucial to optimize your investment portfolio. It helps you understand how much risk you can realistically take on your portfolio. Take a risk profiling quiz and it’ll tell you the ideal allocation across different asset classes.

I’ll give you an example. A 55-year client reached out to me a few months ago. He said he doesn’t find mutual funds worth taking the risk as he always ends up making single-digit returns. When I reviewed his portfolio and asked him to take a risk profiling quiz. As I suspected from the beginning, he had an aggressive risk appetite but he was majorly invested in safer instruments.

Notice the black dot on the diagram. It indicates that his portfolio was inclined towards low risk/low reward, but his risk profile was moderately aggressive. I realigned his portfolio towards moderate risk and he was able to generate desired returns.

That’s why it’s important to understand how much risk you can comfortably take in order to generate desired returns.

As they say, don’t put all your eggs in one basket. Invest your money across equity, debt, gold, real estate, and international equity.

Invest in a combination of growth and safe assets. Growth assets can be your mutual funds, stocks, unlisted shares, etc. You can start mutual fund SIPs for a longer horizon. Safer assets can be your PPF account, FDs, and some debt funds.

Get your portfolio reviewed by an expert and create a solid investment strategy to follow. Periodically review your investments to stay on track of your goals.

Emergencies can wipe out your savings without prior notice. You’ll work hard to save and invest more to retire early. But a sudden expense can derail it all.

An emergency fund is a safety net. When an emergency arises, you can survive on this fund without withdrawing your investments. Because premature withdrawals can break your investment strategy.

Set aside a certain amount that you will only use for emergencies. It should take care of your expenses for at least a year. So multiply your monthly expenses by 12 and that’s your emergency fund in case you lose your job.

Medical emergencies also tend to be expensive. Get good health insurance for you and your family. That’ll take care of your medical bills.

This way, your investments will keep growing. And you will be able to build your retirement corpus in a preferred timeline.

Even after religiously following the three pillars of the FIRE strategy, it may or may not be realistic for everyone. That’s why there are types of FIRE strategies that you can follow based on your financial situation, preferences, and goals.

Lean FIRE: Keeping your expenses lower, save aggressively to ensure your returns cover your post-retirement cost of living, and live a minimalistic lifestyle after retirement as well.

Fat FIRE: Saving and investing a ton of money, aiming for a luxurious lifestyle by building a larger portfolio.

Barista FIRE: Achieving partial financial independence and taking a part-time job to cover expenses. In Barista FIRE, you withdraw a small percentage from your retirement corpus every month and pair it with the income from your part-time job to cover your expenses.

Coast FIRE: Saving and investing wisely so your returns can cover your basic cost of living after retirement without further contributions. Here, you keep your retirement portfolio untouched and earn an income that covers your current expenses.

I have met people who are hardcore on FIRE (metaphorically) so they can retire early. They don’t allow anything that might sidetrack them from their goal. But I have also met some investors, who may not be able to completely retire early but are on a track of financial independence. You can set your own rules.

Life is full of surprises. You have to be prepared for any hurdles you may face on your financial journey.

Market volatility, for instance, can take your investments through ups and downs. Many investors let their emotions take the front seat while making financial decisions. Emotions like fear of losses or greed can break your investment strategy.

You have to trust the process. You will only lose money if you end up making harsh decisions. So, focus on long-term perspective instead of short-term uncertainties.

Learn how to achieve financial security in a volatile market and the dangers of emotional investing. Be a smart investor.

Staying committed to your financial goals makes all the difference. Once you set a goal, you must try everything in your capability to achieve it. That means, having to adjust the budget during economic changes. Cutting down expenses in order to save the desired amount every month. Being a little flexible without compromising on your investments.

I highly recommend reviewing your financial plans every year to see if you are on the right track. If yes, kudos. If not, you can adjust your investments to get back on track.

For any financial strategy to play out, your mindset matters a lot. If you are not emotionally invested in achieving your goals, getting sidetracked is bound to happen.

FIRE is a long-term strategy, not an overnight success. Give your investments the time they deserve to support your lifestyle post-retirement. Remember, the end goal is a worry-free comfortable lifestyle.

If you’ve reached the end, that means you genuinely want to retire early. I’d say your willingness to follow a disciplined approach is a big start.

The next step is to get your portfolio reviewed and create a roadmap to follow to reach the desired destination. Experts at VNN Wealth are happy to accompany you throughout.

Get in touch and let’s plan for your early retirement!