Picture this: You’re sipping a warm cup of coffee with your loved ones, knowing that a steady stream of income is flowing into your bank account. Even better if you don’t have to work for it.

This vision of financial independence is achievable through smart investments. You can generate a steady stream of income for your retirement or simply have passive income for your family.

Two of the popular options investors explore to generate regular income are:

1. Real estate investments for rental income

2. Income from mutual funds via systematic withdrawal plan (SWP)

In this blog, we will discuss both these options in more detail, exploring how they work, how much initial investment is required, and what their advantages and drawbacks are.

Real estate investment involves purchasing a residential or commercial property. As it’s a tangible asset, you own it in a physical form.

In order to generate consistent income from it, you ideally have to rent out your property with a long-term lease agreement.

The rental income depends upon many factors such as rental yield in the area, property’s condition, and market demand.

Mutual funds are a collection of stocks, bonds, gold, and international equity. You can invest in mutual funds that align with your risk appetite and financial goals.

The ideal way to generate income from mutual funds is to invest for a long horizon, let the money compound, and then start a systematic withdrawal plan. A Systematic Withdrawal Plan (SWP) allows you to set an amount and frequency at which you’d like to receive income. The fund units worth the amount you’ve chosen will be sold and the amount will be transferred to your savings account.

Now, we will compare real estate vs mutual funds for monthly income against various parameters.

Let’s take an example: Vikas wants to generate INR. 50,000 monthly income. He’s exploring both the options- rental income and SWP. Let’s help him figure out what makes more sense…

Your initial investment will vary based on the location, type of real estate property, size, amenities, etc. The rental income depends upon the rental yield in the area. In India, the residential rental yield ranges from 2 to 4%. Here’s a snapshot of the rental yield in different cities in India.

| City | Rental Yield |

| Delhi NCR | 2.79% |

| Bangalore | 3.45% |

| Mumbai | 2.44% |

| Ahmedabad | 3.22% |

| Chennai | 3.10% |

| Hyderabad | 3.16% |

| Pune | 3.09% |

| Kolkata | 3.96% |

Let’s take 3% for the sake of understanding.

For Vikas to generate an income of INR 50,000 from residential real estate, he’ll have to purchase a house worth 2 crores.

Property value = Annual rental income (50000 x 12) / rental yield (0.03- converted into decimal) = 600000/0.03= 2 crores

Now let’s say Vikas pays a 20% downpayment, which is 40 lakhs, he’ll have to take a home loan for the remaining amount i.e. 1.6 crores.

With an 8% home loan rate and 20 years of tenure, his EMI becomes 1,33,830. Even if he generates a rental income of INR 50,000, he will still have an expense of INR. 83,830.

On top of that, Vikas will have to pay the cost of home ownership. Brokerage (1-2% of the total value), stamp duty (4-7%), registration fee (1%), parking space (~10k/month), maintenance charges (varies as per location and amenities), etc.

On the flip side, Vikas will only have to invest 50 lakhs in mutual funds to generate INR. 50,000 monthly income.

Mutual funds deliver superior returns compared to real estate. For the sake of calculations, it’s better to be conservative. So we’ll take 12% p.a. as the average return on your mutual fund investment over a longer horizon.

Investment amount = Annual income (50,000 x 12= 6 lakhs) / 0.12= 50 lakhs

The same income can be drawn from mutual funds via SWP by investing only 50 lakhs instead of 2 crores. Plus, while you withdraw monthly 50K, your remaining amount keeps compounding, so you can keep withdrawing 50K/month for the next 20 years, at least.

With mutual funds, Vikas has an option to invest a small amount via SIP to gradually build his wealth.

| Monthly SIP Amount | Average Return p.a. | Investment Horizon | Wealth Accumulated |

| 20,000 | 12% | 20 years | 1,99,82,958 |

| Total Wealth Accumulated in Mutual Funds | Average Return p.a. | Monthly Regular Income via SWP | Years of Regular Income |

| 1,99,82,958 | 12% | 1,00,000 | 20 |

This example is only for the sake of understanding. Parameters like initial investment amount, investment horizon, and average rate of return may change the calculations.

Real estate investment is usually less risky than mutual funds. Market fluctuations have little impact on real estate. However, you may also face a risk of vacancy, tenant default, holdover tenancy, legal disputes, maintenance issues, etc. Additionally, there’s a chance of depreciation in property value during the economic slowdown.

Real estate delivers potential returns from rental income and property value appreciation. You can expect about 8% to 10% p.a. average return on real estate investment in 10 years. It varies depending on the city, property conditions, economic conditions, etc.

Mutual funds have a certain risk associated with them based on the category and market movements. You can invest in mutual funds based on your risk appetite and financial objectives. Take our risk profiling quiz to understand the equity and debt exposure suitable for you.

The return on your mutual fund portfolio depends upon the type of scheme, investment horizon, market conditions, etc. Mutual funds deliver superior returns in a longer horizon despite market volatility. You can expect 12% p.a. average returns in 10 years. You can even generate 2% to 5% returns over and above average if you periodically review your portfolio and optimize it to generate benchmark-beating returns.

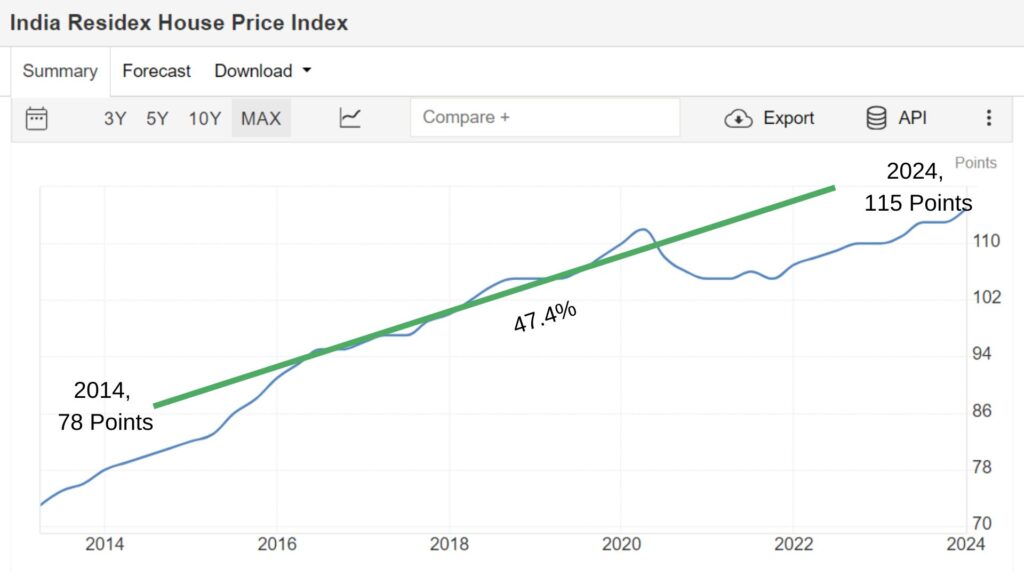

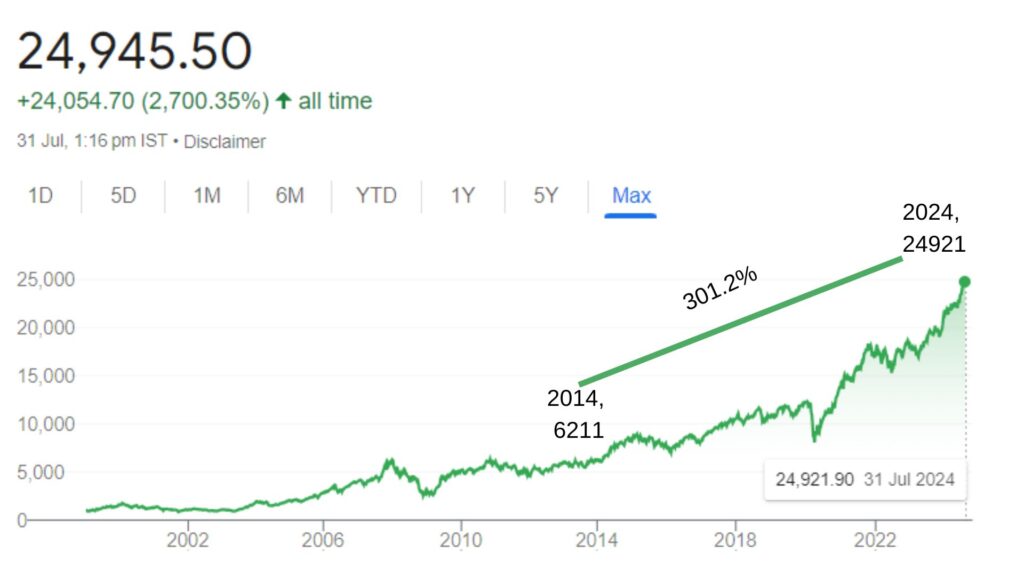

India Residex House Price Index vs Nifty 50 (2014 to 2024)

Residex has grown by 47.4% between 2014 to 2024, whereas Nifty has grown by 301.2%. Evidently, you’ll make better returns from mutual funds compared to real estate.

Real estate investments are less liquid compared to mutual funds. The property sale takes a lot of time. You’ll have to go through the hassle of property transfer paperwork and the cost associated with it. Plus, you may not get the price that you’re looking for. It’s not as easy as redeeming mutual fund units. You have to go out, sit through the negotiations, and handle the transactions.

Additionally, you have to spend a lot of time finding a good property. It requires evaluating the location in person before making a decision. It’s not easily accessible. So if you ever need funds for an emergency, real estate is not reliable.

Mutual funds are highly liquid and accessible online. You can invest and withdraw anytime you want. There’s no lock-in period except for ELSS mutual funds which carry a 3-year lock-in period for the purpose of tax-saving.

Otherwise, you have all the freedom and flexibility to decide the time and amount of investment/withdrawal. When you plan to start an SWP to withdraw income from mutual funds, you can automate the withdrawal amount, frequency, and date. The funds will start flowing into your bank account as per your preferences.

Plus, partial withdrawal is possible in the case of mutual funds which is not an option in real estate. In case of emergencies, you can sell some units of mutual funds, whereas, you cannot sell half your house.

Managing and maintaining real estate property requires a lot of your attention. It’s a never-ending loop of ensuring the property is clean and functional. Following up with tenants and making sure they’re following society's regulations. In some cases, tenants may not leave the property, causing a dispute. Be it residential or commercial, real estate investments demand your time and attention at all times.

Apart from periodic monitoring, you don’t have to look into managing your funds. Mutual fund houses have dedicated fund managers who are experts in handling all the transactions. Fund managers make decisions on the stocks to include in a scheme to leverage market opportunities. All you have to do is invest and let your money compound over the years. Once you achieve your financial goal, you can start/stop SWP anytime as per your income requirements.

The inflation rate in India is around 6 to 7%. The rate of inflation affects your effective return on investment.

Considering the above data:

| Avg Return p.a. | Inflation | Effective Return | |

| Real Estate | 8 to 10% | 6% | 2 to 4% |

| Mutual Funds | 12 to 15% | 6% | 6 to 9% |

In the case of rental income, you can increase the rent by 5 to 8% every year. However, your post-tax returns taking inflation into account cannot beat mutual funds. Mutual funds have the potential to deliver benchmark-beating, inflation-beating returns.

Here are some examples of funds from three different categories outperforming the index:

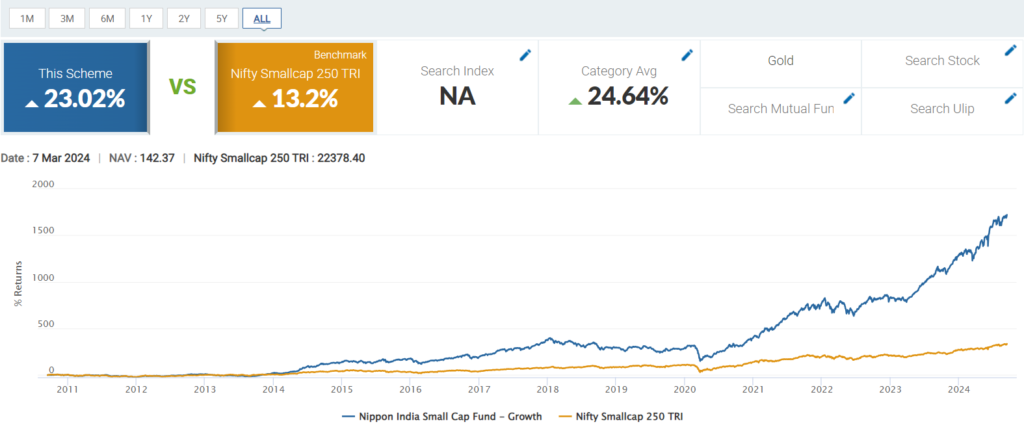

Nippon India Small Cap 10Y Return Against Nifty Smallcap 250

| Fund NAV | Index Closing Value | |

| 10 Jan 2014 | 12.22 | 6278.90 |

| 12 Jan 2024 | 141.13 | 20906.40 |

| Growth | 1055.4% | 232.9% |

| CAGR | 28.4% | 12.8% |

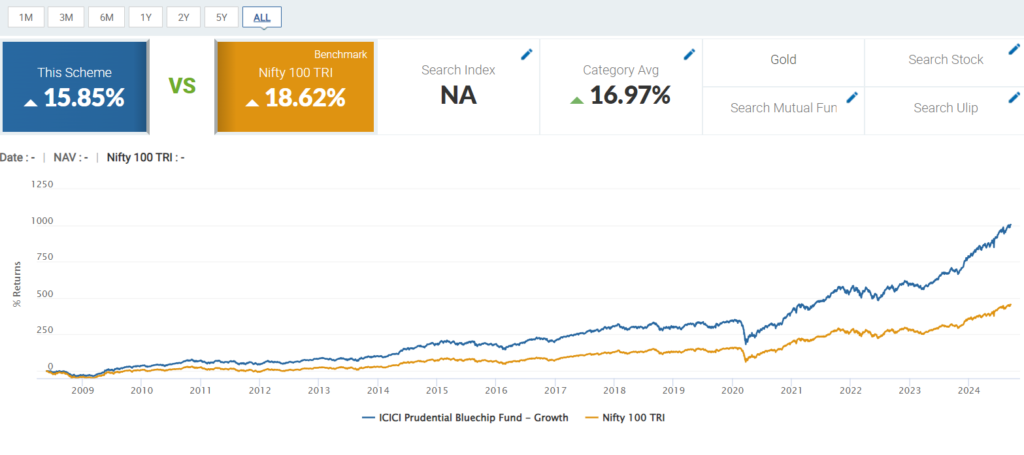

ICICI Prudential Bluechip Fund 10Y Return Against Nifty 100

| Fund NAV | Index Closing Value | |

| 15 Jan 2014 | 20.52 | 6171.25 |

| 15 Jan 2024 | 98.83 | 21508.85 |

| Growth | 381.7% | 248.4% |

| CAGR | 17.2% | 13.2% |

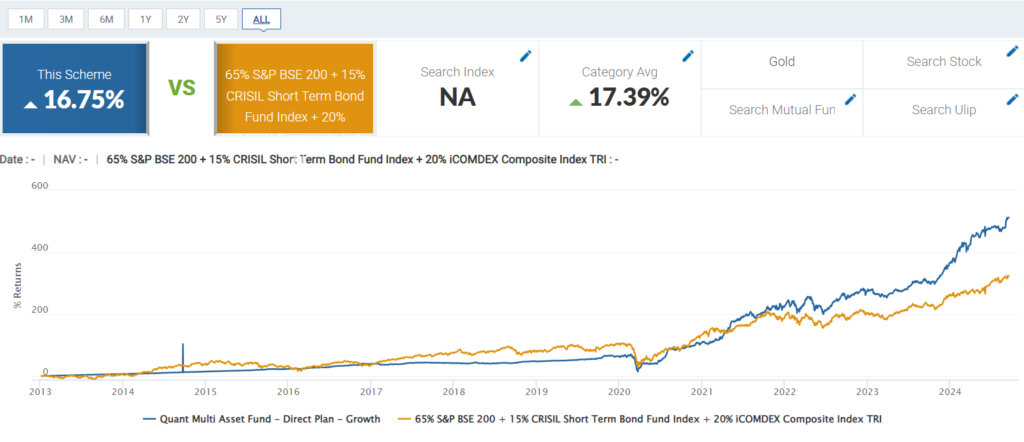

Quant Multi Asset Fund 10Y Return Against S&P BSE 200 & Short Term Bond Fund Index & iCOMDEX Composite Index

| Fund NAV | Index Closing Value | |

| 16 Jan 2014 | 20.05 | 6241.85 |

| 15 Jan 2024 | 117.55 | 21441.35 |

| Growth | 486.4% | 243.5% |

| CAGR | 19.4% | 13.0% |

As you can see, these funds have beat their respective benchmark. The chances of earning more than the average returns are possible with mutual funds.

1. Rental income is taxed as per the investor’s tax slab.

2. If you sell your property after 24 months, you will have to pay long-term capital gain tax. As per budget 2024, you can either opt for old taxation or new taxation, whichever attracts lower tax for you. As per the old tax rule, the long-term capital gains will attract a 20% tax with an indexation benefit. The new tax rule does not offer an indexation tax rule but the long-term gains will be taxed at 12.5%. You can get an exemption on capital gain tax by investing in 54EC bonds within 6 months of property sale/transfer.

3. You can claim an exemption on interest paid on a home loan up to a maximum of 2 lakhs under section 24. In the case of a let-out property, you can claim an exemption against the entire interest paid.

For equity-oriented mutual funds:

Short term capital gain tax of 20% will be applicable on funds withdrawn within 12 months of investment.

Long-term capital gain tax of 12.5% above 1.25 lakhs will be applicable on funds withdrawn after 12 months.

For debt-oriented funds

Both short and long-term capital gains will be taxed as per the investor’s tax slab.

You can claim exemption against ELSS mutual fund investment of up to 1.5 lakhs under section 80C of the IT Act.

| Real Estate | Mutual Funds | |

| Asset type | Tangible. Physical property. | Intangible. Units of mutual funds that are a combination of stocks and bonds. |

| Initial Investment Amount | Higher | Lower |

| Return on Investment | Rental income, price appreciation Average 8 to 10% p.a. | Capital gains and dividends. Average 12 to 15% p.a. |

| Liquidity | Low | High |

| Risk | Market slowdown, tenant default, legal disputes, maintenance, vacancy issues, etc. | Market performance |

| Management and Maintainance | High and costly | Professional management by fund houses. Low maintenance. |

Real estate has always been a popular investment option in India. Even today if you ask your parents or grandparents, they'll advise you to invest in real estate. Their advice comes from an era when mutual funds weren’t regulated. The UTI mastershare fraud had broken people’s trust in mutual funds. Therefore, they preferred physical assets such as gold, real estate, cash savings, etc. Plus there’s a sentimental value attached to buying a property, mostly because it seems safer. You own a tangible property and control everything around it. And sure, if you’re insistent on buying a home to secure your family’s future, to have a place to call your own, you can definitely consider buying one.

But for the sake of generating income, mutual funds are better suited. Now SEBI regulates mutual funds to ensure investors’ money is safeguarded. You can invest as per your risk appetite, decide the amount and frequency, and let the fund managers handle the fund’s growth while your money compounds.

The clear winner here is the systematic withdrawal plan.

Investors often consider purchasing property to generate passive income without assessing their overall portfolio. However, mutual funds are clearly more feasible to generate regular income. The initial capital required to invest in mutual funds is significantly lower than in real estate. Plus, the cost of home ownership, the time and energy required to maintain the property, the slow growth, and low liquidity make real estate less appealing.

Mutual funds are highly liquid. You can start investing a small amount by SIP and accumulate wealth over the years. When you’re ready to withdraw income, you can easily set up an SWP online. Unlike real estate, mutual funds have the potential to deliver benchmark-beating, inflation-beating returns if you truly diversify your portfolio and periodically optimize it.

Take a risk profiling quiz and review your portfolio today. Learn more about the Systematic withdrawal plan from our experts and revamp your portfolio to generate monthly income.